手動上下昇降デスク140 × 70 高さ変更可

(税込) 送料込み

商品の説明

特徴···完成品、高さ調節可

サンワサプライの昇降式デスクです。2022年の1月頃39,で購入しました。1年半程使用しましたが、引越しに伴い出品させて頂きます。梱包・発送頼める便でお届け致します。

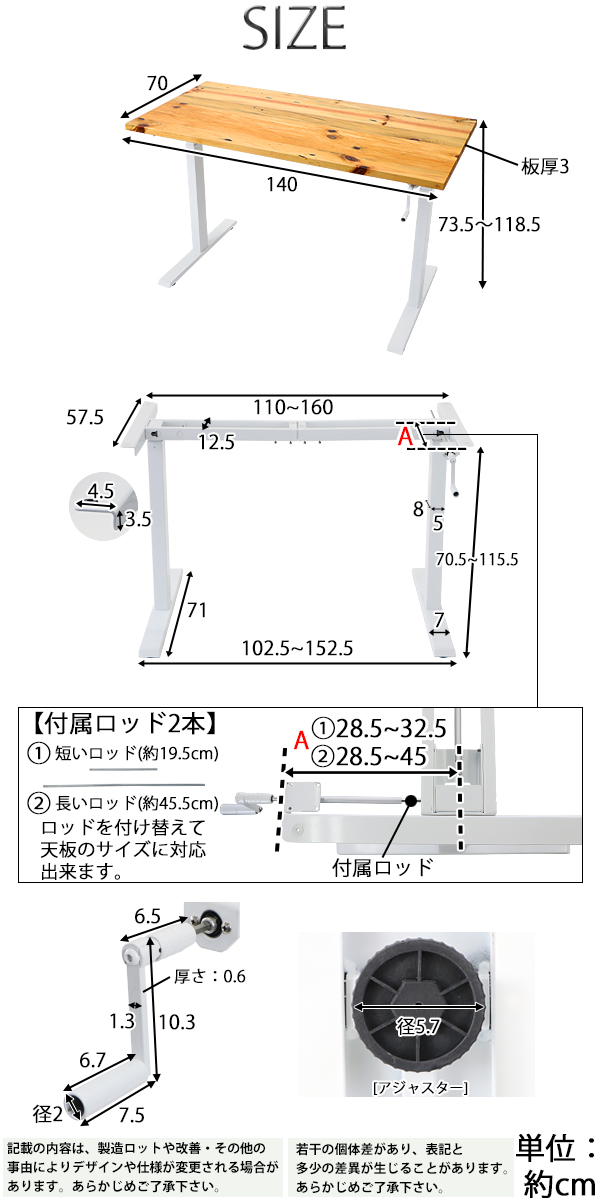

●サイズ:

縦幅 70cm

横幅 140cm

高さ 72〜123cm

●素材:主にスチール

●付属品:

説明書・付属六角ペンチ

●その他、注意事項:

目立った傷や汚れなどありませんが写真をご確認の上、中古品であるということをご理解いただきご購入をお願いします。商品の情報

| カテゴリー | インテリア・住まい・小物 > 机/テーブル > パソコン用 |

|---|---|

| ブランド | サンワサプライ |

| 商品の状態 | 目立った傷や汚れなし |

電源不要で回転式レバーで手軽に上下昇降出来る幅140cm、奥行70cmの

手動上下昇降デスク140 × 70 高さ変更可 - パソコン用

楽天市場】スタンディングデスク 昇降 手動 昇降デスク 座りすぎ防止

昇降デスク 手動 W1400×D700×H735〜1185mm パイン材 高級 木製 天板

電源不要で回転式レバーで手軽に上下昇降出来る幅140cm、奥行70cmの

電源不要で回転式レバーで手軽に上下昇降出来る幅140cm、奥行70cmの

電源不要で回転式レバーで手軽に上下昇降出来る幅140cm、奥行70cmの

楽天市場】送料無料 昇降デスク 手動 W1400×D700×H735〜1185mm パイン

楽天市場】電動 昇降デスク メモリー機能付き 簡単操作 幅140 高さ71

スタンディングデスク(昇降) 商品一覧 【パソコンデスク通販のデスク市場】

楽天市場】電動 昇降デスク メモリー機能付き 簡単操作 幅140 高さ71

電源不要で回転式レバーで手軽に上下昇降出来る幅140cm、奥行70cmの

電源不要で回転式レバーで手軽に上下昇降出来る幅140cm、奥行70cmの

昇降デスク 手動 W1600×D800×H735〜1185mm 耐荷重約70kg(脚部

Amazon.co.jp: FLEXISPOT 昇降式デスク 電動 V字型 パソコンデスク

楽天市場】電動 昇降デスク メモリー機能付き 簡単操作 幅140 高さ71

FlexiSpot | EG1

楽天市場】送料無料 昇降デスク 手動 W1400×D700×H735〜1185mm 耐荷重

Amazon.co.jp: サンワダイレクト: 昇降デスク

FlexiSpot | 電動昇降式デスクE7

完成品】ニトリ 昇降デスク 手動式-

昇降デスク 手動 W1400×D700×H735〜1185mm パイン材 高級 木製 天板

楽天市場】【P5倍 11/13 9:59迄】昇降 ゲーミングデスク 手動式

昇降式 パソコンデスク 140の人気商品・通販・価格比較 - 価格.com

電動で上下昇降出来る幅140cm、奥行70cmのスタンディングデスク

楽天市場】【P5倍 11/13 9:59迄】L字 電動 昇降デスク メモリー機能

Garage(ガラージ) GX-168LJ-L-NC | ファントーニ GX デスク 上下昇降

楽天市場】スタンディングデスク 昇降 手動 昇降デスク 座りすぎ防止

Amazon.co.jp: 昇降デスク 手動 W1400×D700×H735~1185mm 耐荷重約70kg

スタンディングデスク(昇降) 商品一覧 【パソコンデスク通販のデスク市場】

2023年最新】サンワサプライ/パソコン用の人気アイテム - メルカリ

楽天市場】【P5倍 11/13 9:59迄】L字 電動 昇降デスク メモリー機能

昇降式 パソコンデスク 140の人気商品・通販・価格比較 - 価格.com

FlexiSpot |電動昇降式デスク EF1

楽天市場】【P5倍 11/13 9:59迄】L字 電動 昇降デスク メモリー機能

楽天市場】スタンディングデスク 昇降 手動 昇降デスク 座りすぎ防止

昇降式 パソコンデスク 140の人気商品・通販・価格比較 - 価格.com

FlexiSpot| 電動昇降式デスクQ8

パソコンデスク ゲーミングデスク 机 幅120cm 奥行60cm おしゃれ

電源不要で回転式レバーで手軽に上下昇降出来る幅140cm、奥行70cmの

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています