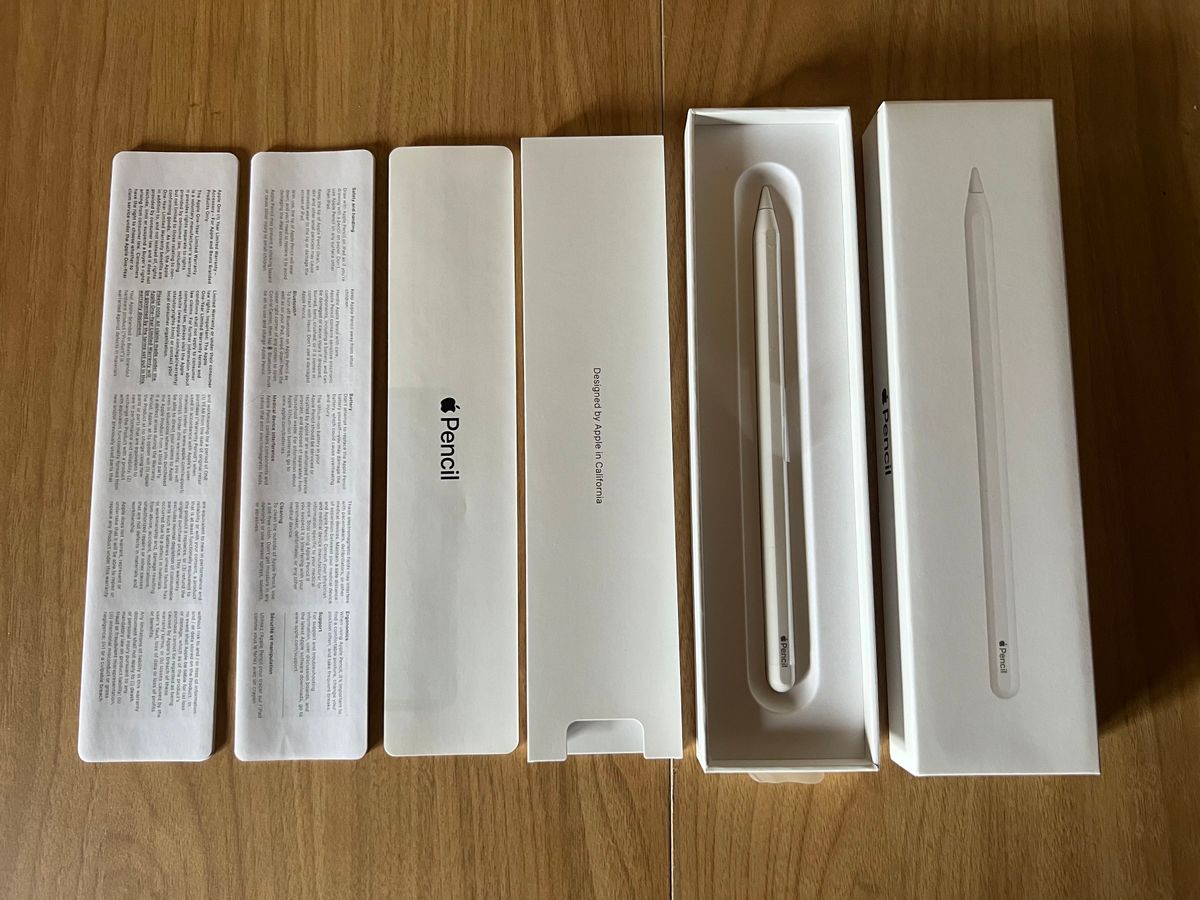

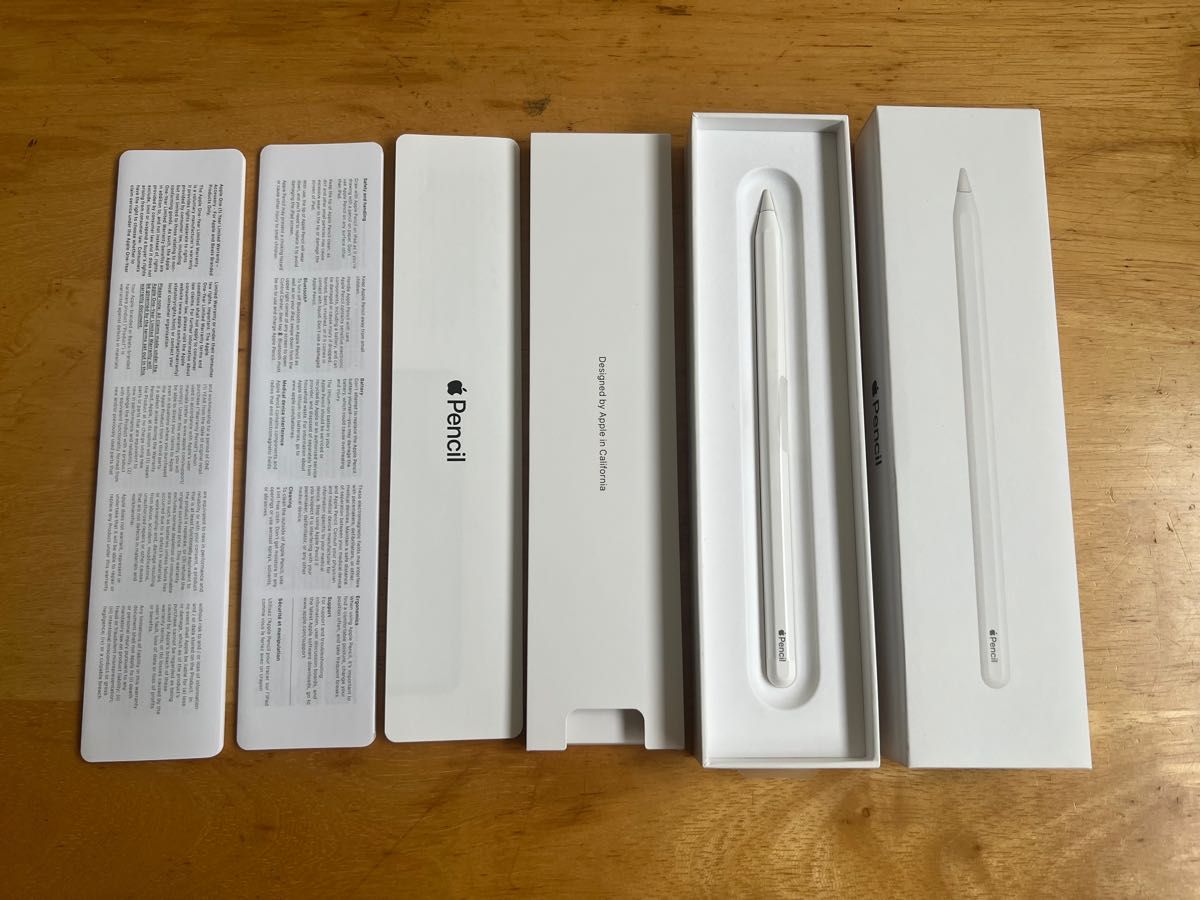

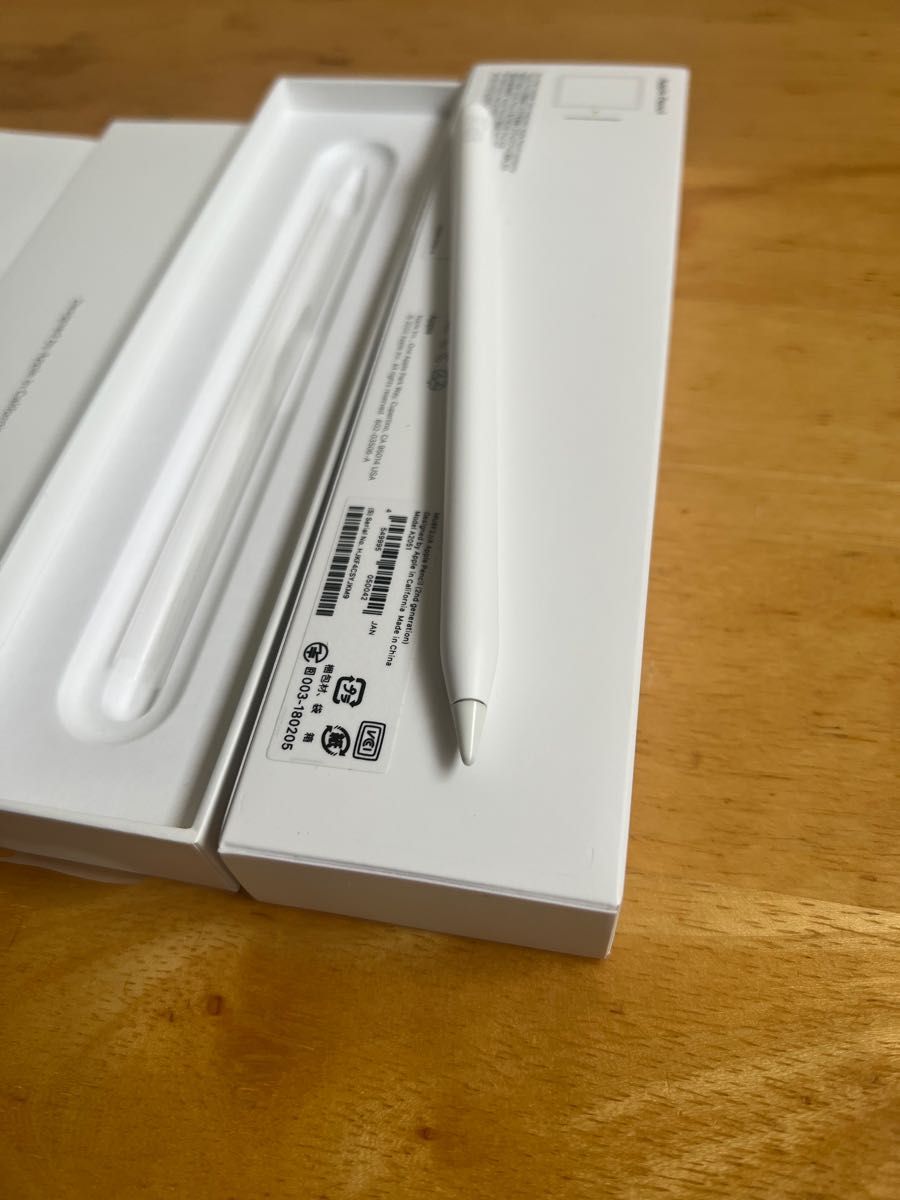

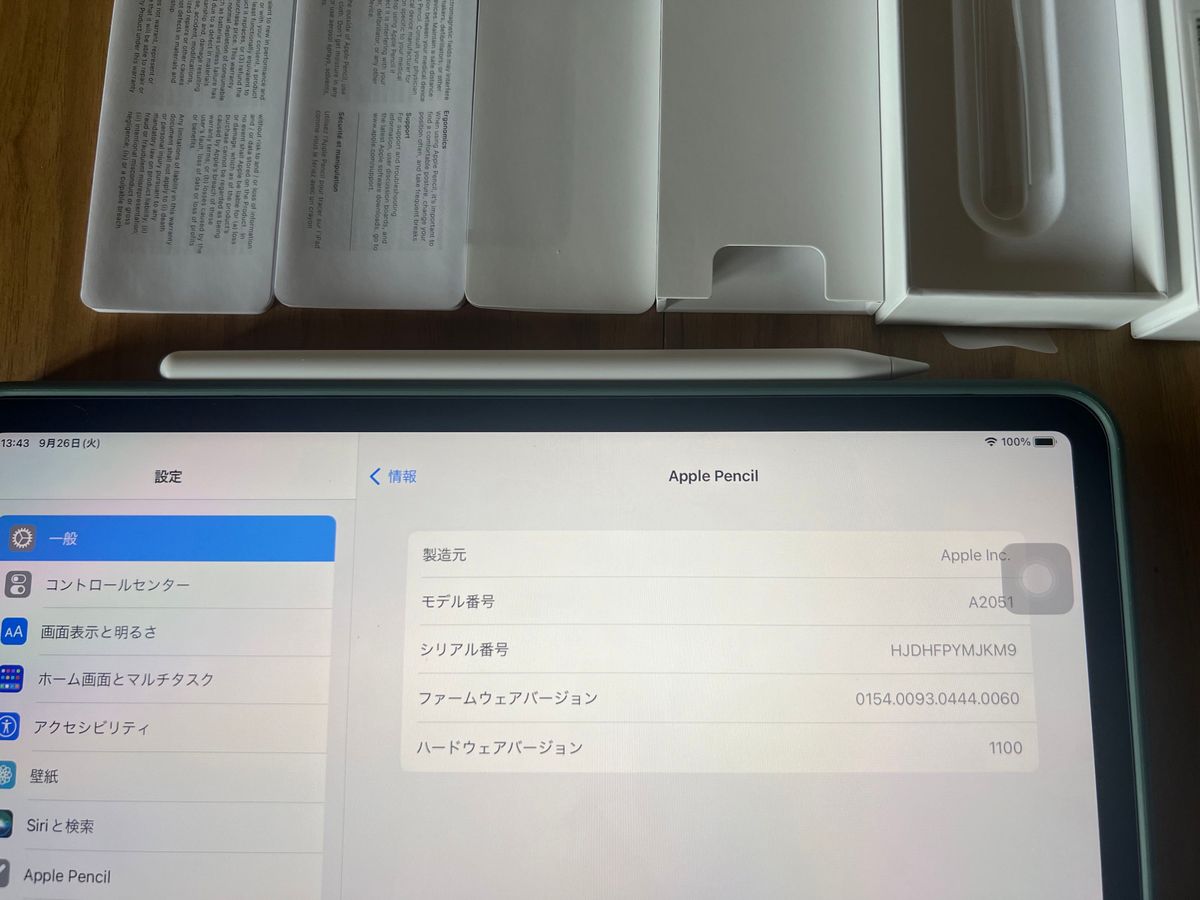

Apple Pencil(第2世代)A2051 アップルペンシル 動作品

(税込) 送料込み

商品の説明

商品の説明

●商品情報

購入日:2021年

第2世代のApple pencilです。

定価: 19,

〜動作確認〜

・筆圧感知◎

・バッテリー磁気充電◎

●商品状態

肉眼で見る限り、目立った傷はございません。

●備考

対応するモデル(Apple公式ホームページより引用)

12.9インチiPad Pro(第3世代、第4世代、第5世代、第6世代)

11インチiPad Pro(第1世代、第2世代、第3世代、第4世代)

iPad Air(第4世代、第5世代)

iPad mini(第6世代)商品の情報

| カテゴリー | 家電・スマホ・カメラ > PC/タブレット > PCパーツ |

|---|---|

| ブランド | アップル |

| 商品の状態 | 目立った傷や汚れなし |

上質で快適 第2世代 アップルペンシル Pencil Apple A2051

日本未発売】 A2051 Model MU8F2J/A Bluetooth (第2世代) アップル

美品箱付き Apple Pencil A2051 第2世代 アップルペンシル a-

おすすめネット 美品✨Apple Pencil A2051 第2世代 アップルペンシル⑤

美品箱付き Apple Pencil A2051 第2世代 アップルペンシル a-

Apple Pencil アップルペンシル(第2世代)動作品 ②-siegfried.com.ec

驚きの価格が実現! アップルペンシル A2051 MU8F2J/A 第2世代 Pencil

大人気の 【美品】Apple Pencil 第2世代 アップルペンシル(第2世代

刻印入り】 apple pencil アップルペンシル 第2世代 A2051-

売れ筋商品 美品 純正品 Apple Pencil 第2世代 動作確認済み アップル

日本未発売】 A2051 Model MU8F2J/A Bluetooth (第2世代) アップル

保証残あり】Apple Pencil アップルペンシル 第2世代 MU8F2J/A A2051

美品】Apple Pencil アップルペンシル 第2世代 MU8F2J/A A2051 純正品

楽天市場】Apple Pencil 第2世代 アップルペンシル MU8F2J/A 純正品

日本未発売】 A2051 Model MU8F2J/A Bluetooth (第2世代) アップル

刻印入り】 apple pencil アップルペンシル 第2世代 A2051-

美品】Apple Pencil アップルペンシル 第2世代 MU8F2J/A A2051 純正品

4年保証』 ( く-L-1401 )Apple Pencil アップルペンシル 003-180205 第

極美品 】Apple Pencil アップルペンシル 第2世代 MU8F2J/A A2051 純正

美品 】Apple Pencil アップルペンシル 第2世代 MU8F2J/A A2051 純正品

上質で快適 Apple Pencil 第2世代 MU8F2J/A A2051 中古美品 その他

美品 】Apple Pencil アップルペンシル 第2世代 MU8F2J/A A2051 純正品

楽天市場】【19日20時からポイントUP!お買い物マラソン あす楽発送

極美品 】Apple Pencil アップルペンシル 第2世代 MU8F2J/A A2051 純正

動作未確認】Apple Pencil 第2世代 MU8F2J/A A2051 アップルペンシル

本物新品保証】 【動作確認済】Apple Pencil 第2世代【保証未登録

Apple Pencil (第2世代) モデル:A2051-connectedremag.com

美品 】Apple Pencil アップルペンシル 第2世代 MU8F2J/A A2051 純正品

ランキング第1位 純正品 第2世代 Pencil Apple 動作確認済 箱付属品付

Apple Pencil アップルペンシル(第2世代)動作品 ②-siegfried.com.ec

美品 Apple Pencil 第2世代 MU8F2J/A A2051 iPad用 タッチペン

Apple Pencil (第2世代) モデル:A2051-connectedremag.com

美品 】Apple Pencil アップルペンシル 第2世代 MU8F2J/A A2051 純正品

Apple Pencil 第2世代 MU8F2J/A A2051-

Apple - 【保証あり】Apple Pencil アップルペンシル(第2世代)の通販

Apple Pencil アップルペンシル(第2世代)動作品 ②-siegfried.com.ec

BS44 【未開封】Apple Apple Pencil 第2世代 A2051 MU8F2J/A アップル

未使用に近い極美品 】Apple Pencil アップルペンシル 第2世代 MU8F2J

Apple Pencil 第2世代 美品 動作確認済み - タブレット

超目玉枠】 美品 Apple Pencil アップルペンシル第2世代 A2051

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています