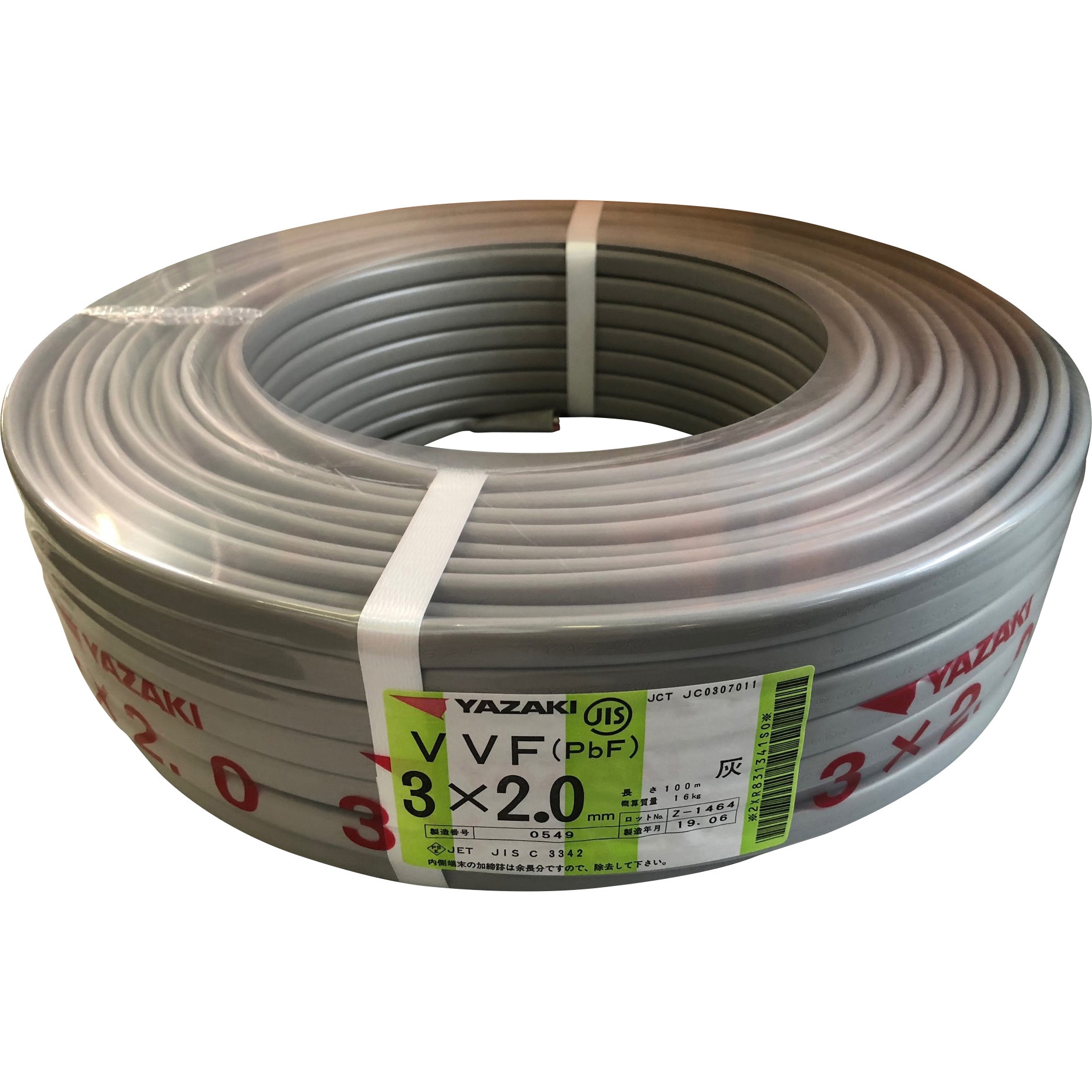

2個セット YAZAKI VFF 2×2.0 Fケーブル

(税込) 送料込み

商品の説明

未使用品です。

製造日から一年以上経っている物になります。

ご確認、ご了承の上ご購入下さい。

包装のビニールに黄ばみや傷などあります。

領収書などは発行できません。

まとめ売りなどもできます。

お気軽にご相談ください。

※写真は使い回しですが同じ状態の物を発送致します。商品の情報

| カテゴリー | 家電・スマホ・カメラ > オーディオ機器 > ケーブル/シールド |

|---|---|

| 商品の状態 | 目立った傷や汚れなし |

2個セット YAZAKI VFF 2×2.0 Fケーブル 入荷 49.0%割引 www

2個セット YAZAKI VFF 3×2.0 Fケーブル 高級品市場 49.0%割引 www

楽天市場】YAZAKI 矢崎 電線 VVFケーブル 2.0mm×3芯 100m巻 (灰色

超格安価格 2個セット YAZAKI Fケーブル 3×1.6 VFF ケーブル/シールド

ケーブル VVF2.0-2 200m YAZAKI 【早い者勝ち‼︎】-

□VVFケーブル 3×1.6mm YAZAKI 2巻□ | tradexautomotive.com

から厳選した ケーブル YAZAKI VVF 2巻 VVF2×1.6(黒.白) 電線

ケーブル VVF2.0-2 200m YAZAKI 【早い者勝ち‼︎】-

大人気新品 VVF 1巻です。 VVF2×2.0 電線 YAZAKI ケーブル ケーブル

Amazon | 矢崎 VVFケーブル(2.0mm×2C) 灰 100m | 多芯ケーブル | 産業

![値下げ中》VVF ケーブル YAZAKI 電線 VVF2×2.0 [宅送] 4142円引き www](https://static.mercdn.net/item/detail/orig/photos/m84402111551_1.jpg)

値下げ中》VVF ケーブル YAZAKI 電線 VVF2×2.0 [宅送] 4142円引き www

◇◇YAZAKI 矢崎総業株式会社 電材 VVFケーブル 2×2.0mm solari.ec

楽天市場】電線 VVFケーブル 2.0mm×2芯 100m 富士電線 YAZAKI 弥栄電線

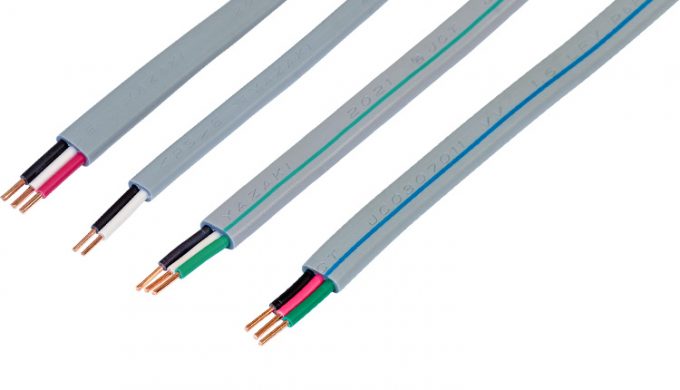

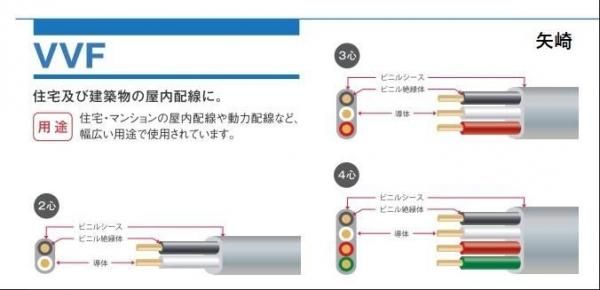

600Vビニル絶縁 ビニルシースケーブル (VVF) | 製品情報 | 矢崎

Fケーブル VVF2.0-2 YAZAKI 【200m】 culto.pro

くらしを楽しむアイテム 未使用品 YAZAKI 矢崎エナジーシステム VVF

(送料無料) VVF2.0mm×2 電線 VVFケーブル 2.0mm×2芯 100m巻

YAZAKI VFF 2×2.0 2×1.6セット Fケーブル 若者の大愛商品 www

〇〇YAZAKI ヤザキ VVFケーブル 2芯 2× 2.0 PbF 100m - その他

YAZAKI 矢崎エナジーシステム VVF(PbF)ケーブル 3×2.0mm 灰/黒・白

YAZAKI 電線 ケーブル VVF2×2.6mm 新品 8670円 www.geyrerhof.com

VVFケーブル 2.0x3C (黒白緑)(NEXCO指定)(矢崎電線) | monsterdog.com.br

YAZAKI 新品未使用VVFケーブル VVF2.0-3c 100m 1巻 期間限定30%OFF

ケーブル VVF2.0-3 YAZAKI 【早い者勝ち‼︎】 | tradexautomotive.com

中古】 YAZAKI 矢崎《 VVFケーブル 平形 》100m巻 / 灰色 / VVF2×2.0

YAZAKI 矢崎 電線 VVFケーブル 2.0mm×2芯 100m巻 (灰色) VVF2.0×2C

矢崎電線 YAZAKI VVF2.0-2C(黒白)100m x2 新品未使用-

矢崎 VVF2.0-2C 600Vビニル絶縁ビニルシースケーブル平型 2心 2.0mm

Amazon | 矢崎 VVFケーブル (1.6mm×2C) | 多芯ケーブル | 産業・研究

☆ツールオフ鴻巣店☆【未使用品】VVFケーブル 2×2.0mm 100m巻

〇〇YAZAKI ヤザキ VVFケーブル 2芯 2× 2.0 PbF 100m - その他

YAZAKI 電線 ケーブルVVF2×2.0 (白.黒) 2巻 【希望者のみラッピング

▽▽ YAZAKI VVFケーブル(pbF) 2x2.0mm 長さ100m 概算質量11kg 未使用

楽天市場】電線 VVFケーブル 灰色 2.0mm×3芯 100m巻 富士電線 YAZAKI

中古】 YAZAKI 矢崎《 VVFケーブル 平形 》100m巻 / 灰色 / VVF2×2.0

売りです VVF2.0-3C (黒白緑) 矢崎 VVFケーブル ① 建築材料、住宅

新品 ヤザキ 2.0mm×2C VVFケーブル - 通販 - gofukuyasan.com

矢崎 YAZAKI 2.0mm×2芯 100m巻 VVF2.0×2C×100m VVF ケーブル 600V 新品

香川県高松市のお客様から「矢崎 VVFケーブル 3×2.0mm 」を買取り

Fケーブル 2.0-3c 200v emmanuelfranca.com.br

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています