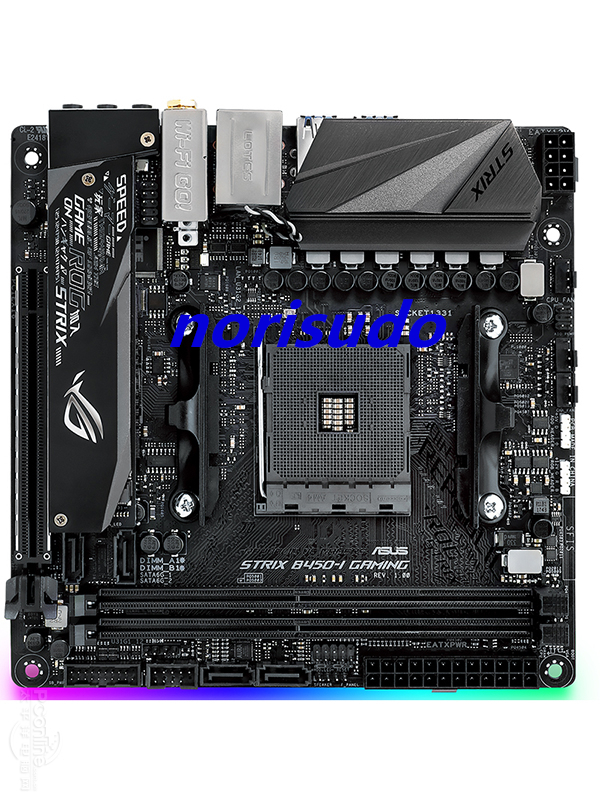

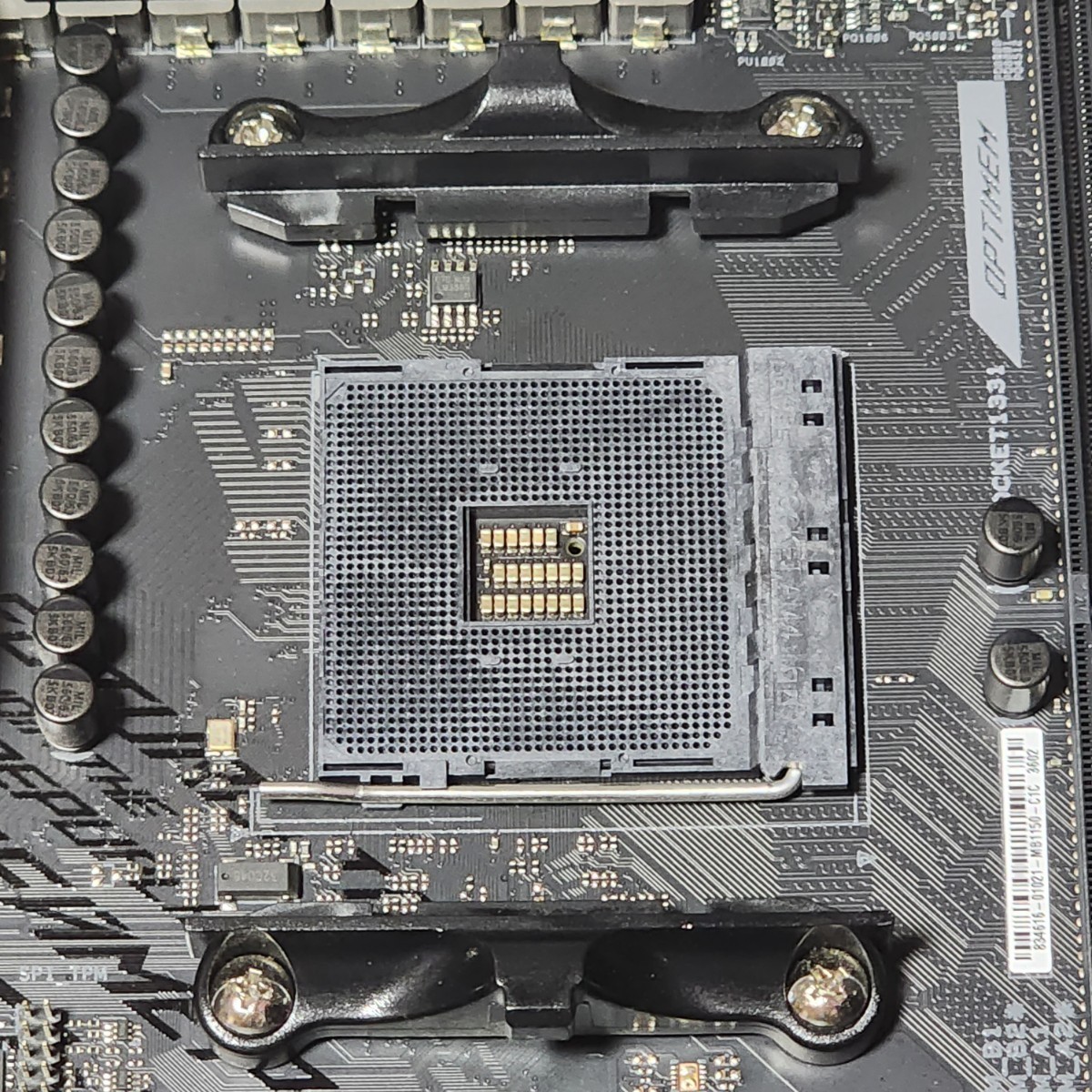

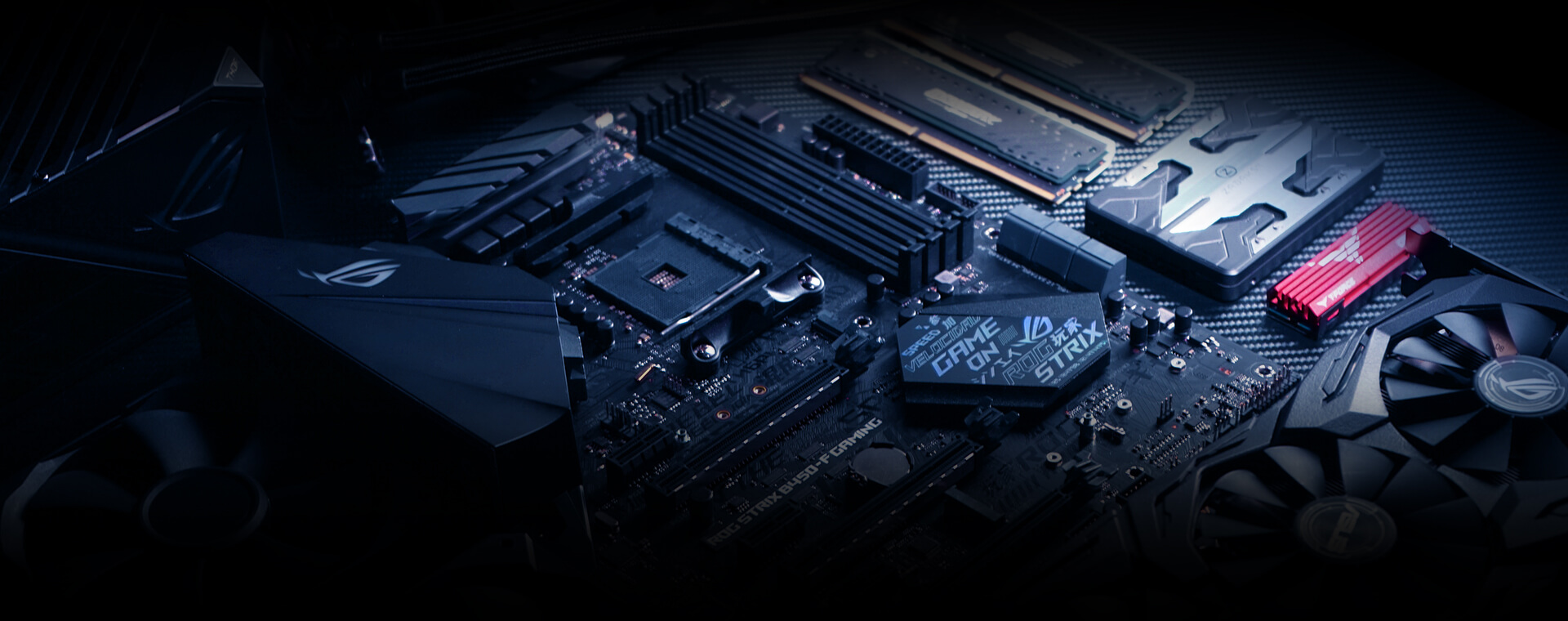

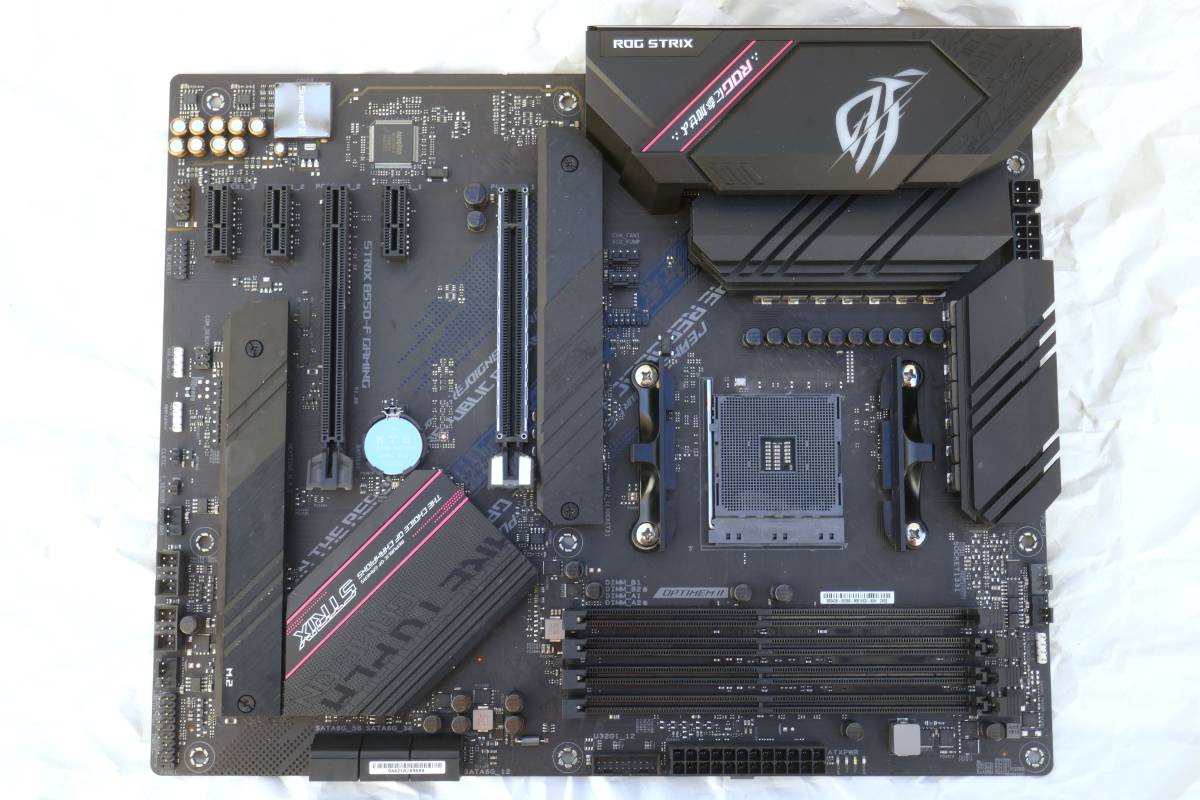

ASUS ROG STRIX B450-I GAMING 【動作確認済み】

(税込) 送料込み

商品の説明

2年ほど前に購入しましたが拡張性に不満を

感じていてmicro ATXのものに

買い換えたので出品します。

小さいケースにも入るmini itxです!

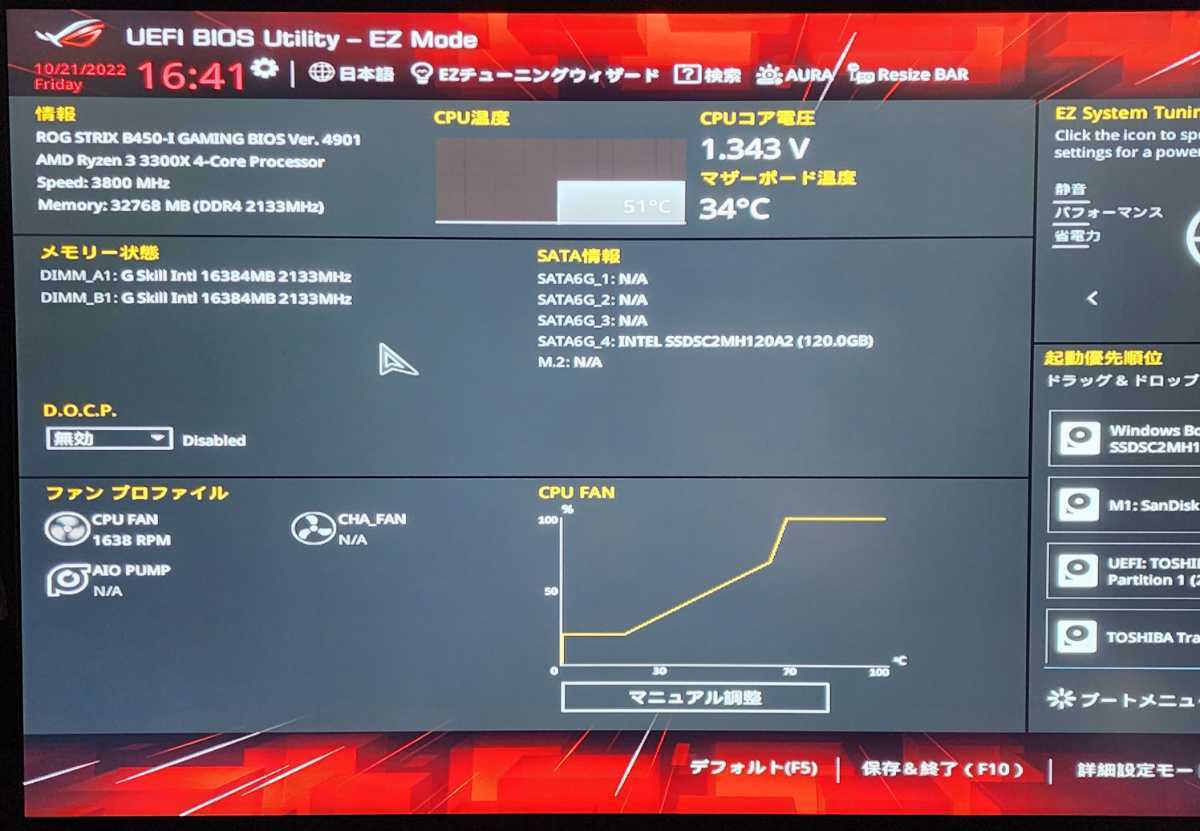

Biosアップデート済みなので

Ryzen5000番台のCPUも使えます。

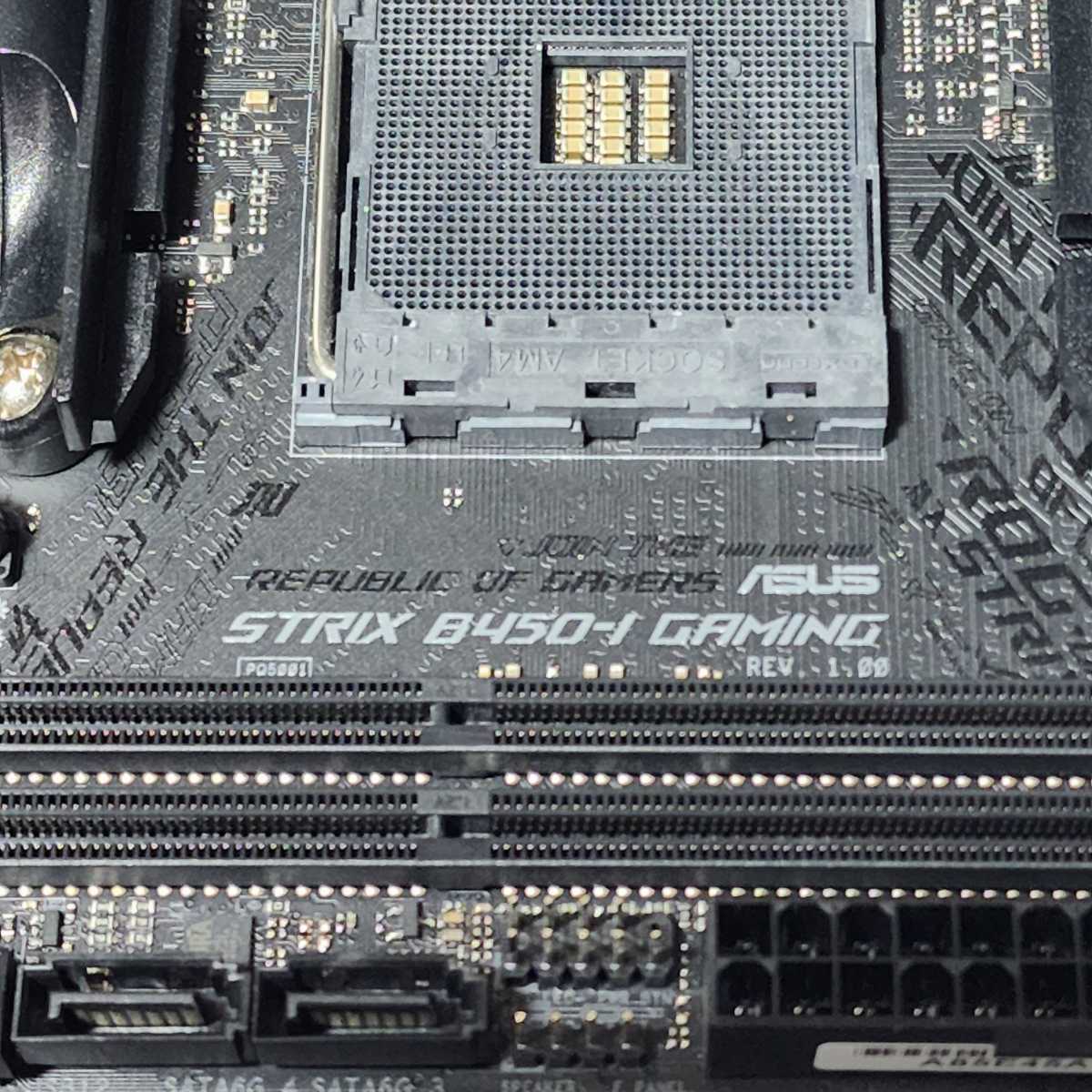

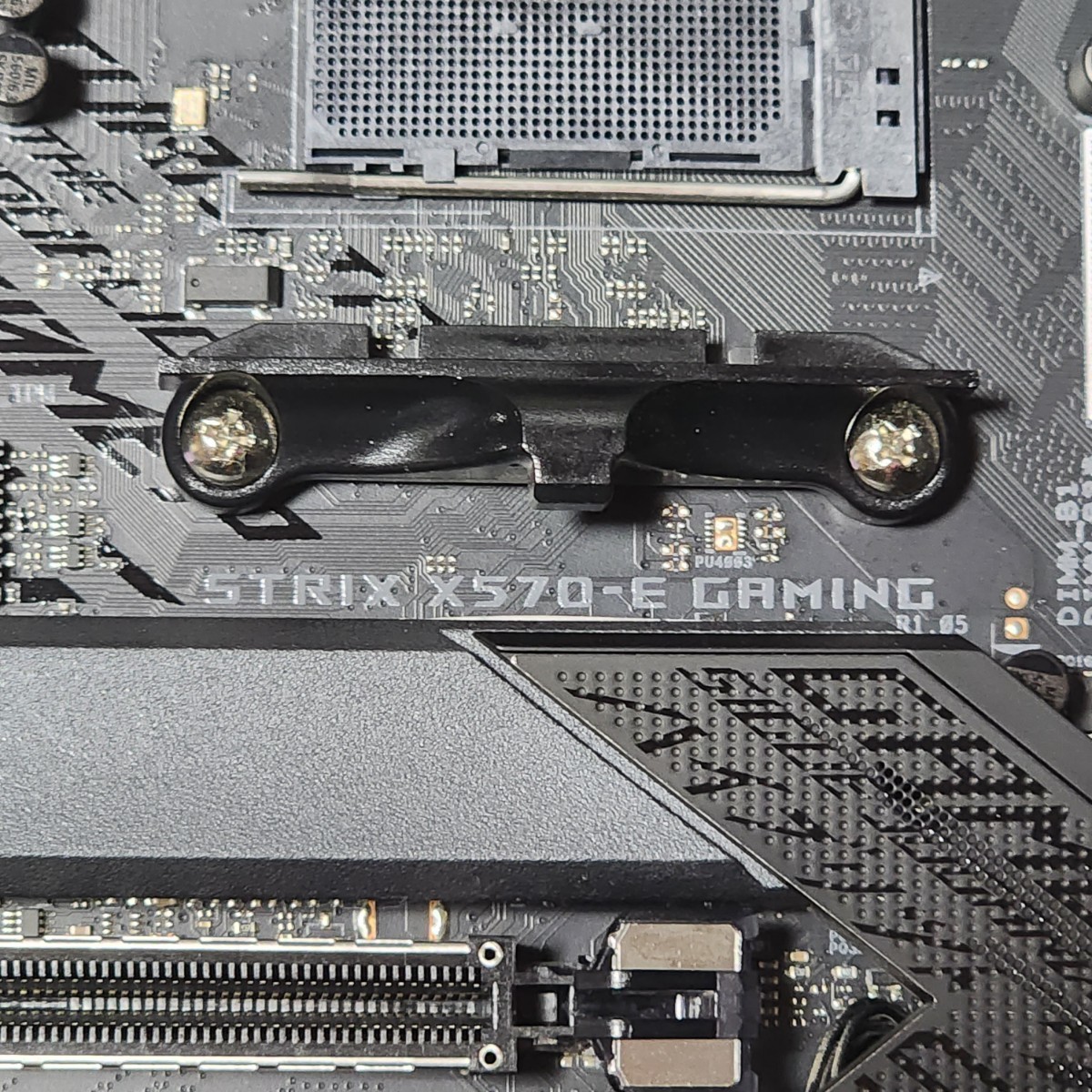

少し埃が付着しているところがありますが

ご了承ください。

Wifiアンテナは付属のものでなく、

緩んでいますが使用に問題はありません。

バックプレート付属しません。

#b450 #b550 #miniitx #mini #itx商品の情報

| カテゴリー | 家電・スマホ・カメラ > PC/タブレット > PCパーツ |

|---|---|

| 商品の状態 | やや傷や汚れあり |

ASUS ROG STRIX B450-I GAMING-

オンラインショップ】 GAMING B450-I STRIX ROG Mini-ITXマザーボード

美品 ASUS ROG STRIX B450-I GAMING 【Mini ITX マザーボード】AMD

ASUS ROG STRIX B450-I GAMING-

ASUS ROG STRIX B450-I Gaming おすすめ 40.0%割引 www.geyrerhof.com

ASUS ROG STRIX B450-I GAMING IOパネル付属 Socket AM4 Mini-ITXマザーボード RYZEN5000シリーズ対応 最新Bios 動作確認済 PCパーツ

ASUS ROG STRIX B450-I GAMING IOパネル付属 Socket AM4 Mini-ITXマザーボード RYZEN5000シリーズ対応 最新Bios 動作確認済 PCパーツ

2023年最新】ROG STRIX B450-I GAMINGの人気アイテム - メルカリ

日本限定モデル】 GAMING B450-I STRIX ROG AMD ASUS Socket

ASUS ROG STRIX B450-I GAMING-

ASUS ROG STRIX B450-I GAMING IOパネル付属 Socket AM4 Mini-ITXマザーボード RYZEN5000シリーズ対応 最新Bios 動作確認済 PCパーツ

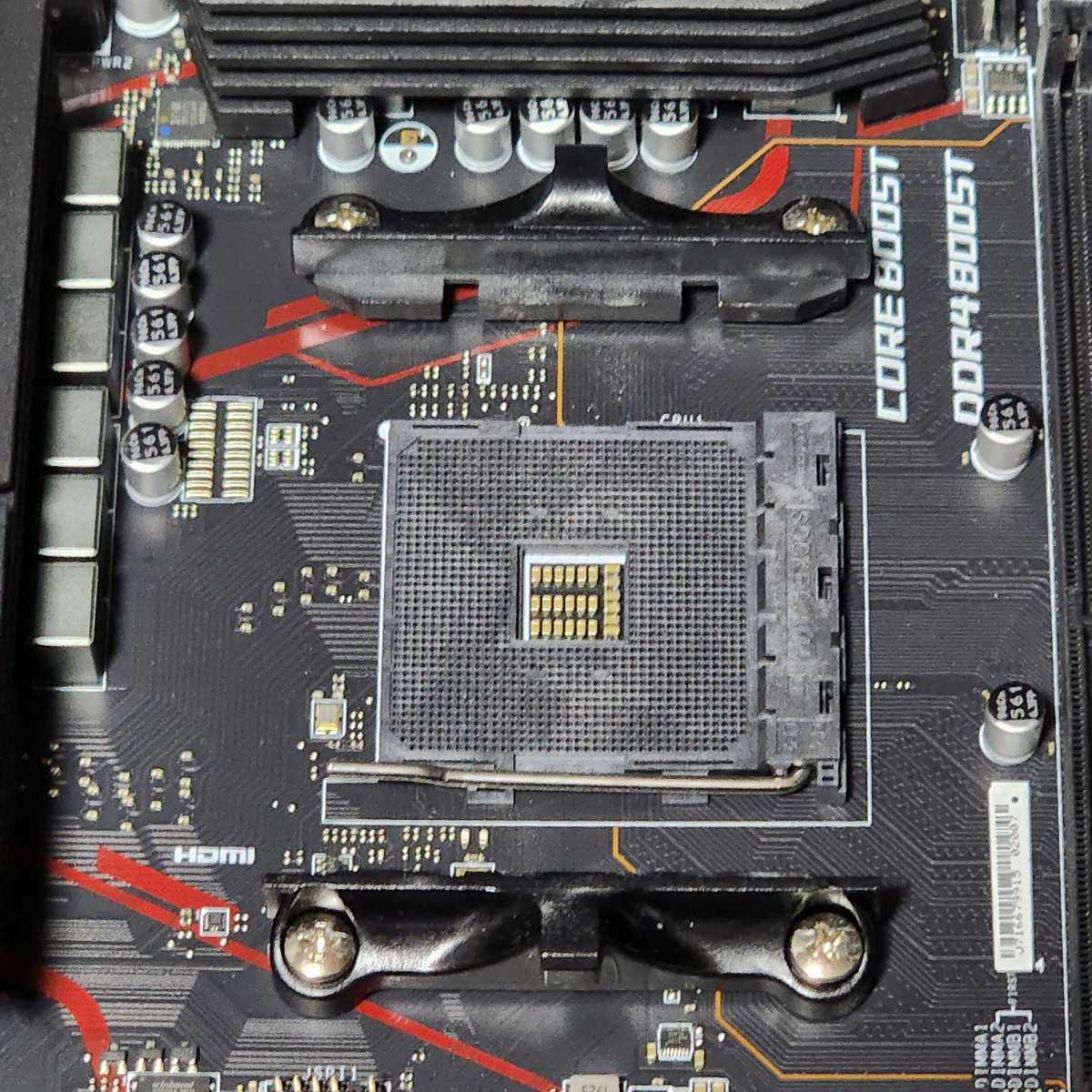

幸せなふたりに贈る結婚祝い RYZEN5000シリーズ対応 ATXマザーボード

☆お求めやすく価格改定☆ 【動作動画収録・Socket GAMING B450-I

送料無料 RYZEN5000シリーズ対応 ATXマザーボード AM4 Socket IOパネル

送料無料 RYZEN5000シリーズ対応 ATXマザーボード AM4 Socket IOパネル

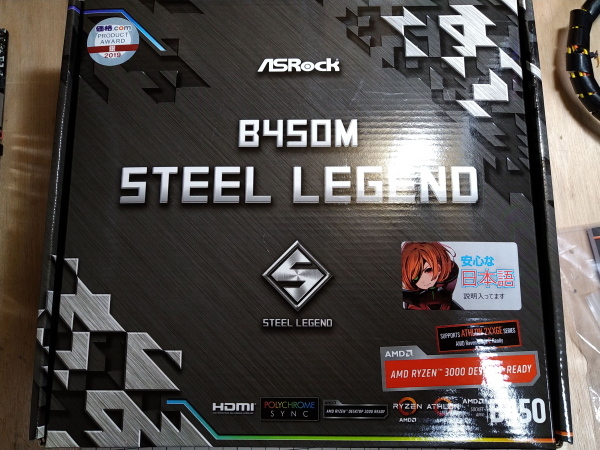

送料無料 #マザーボード ASRock B450 動作確認済み中古品美品 Legend

ASUS ROG STRIX B450-I GAMING 【動作確認済み】

ASUS ROG GAMINGシリーズのMini-ITXモデル「B350-I」「B450-I」「B550

MSI MPG X570 GAMING PLUS IOパネル付属 Socket AM4 ATXマザーボード

最安価格 GAMING Z390M-PRO TUF ASUS IOパネル付属 PCパーツ 動作確認

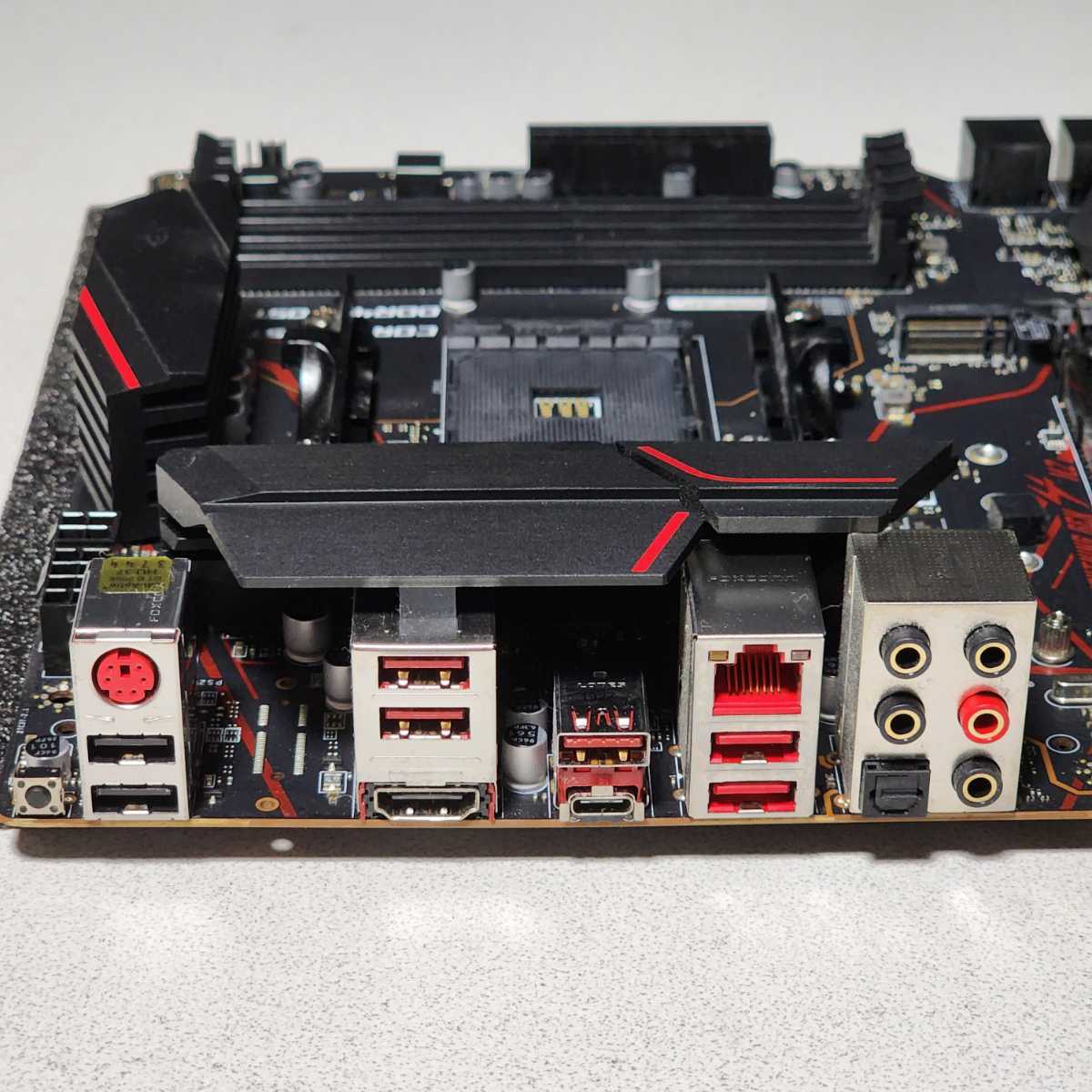

ROG STRIX B450-F GAMING | マザーボード | ROG Japan

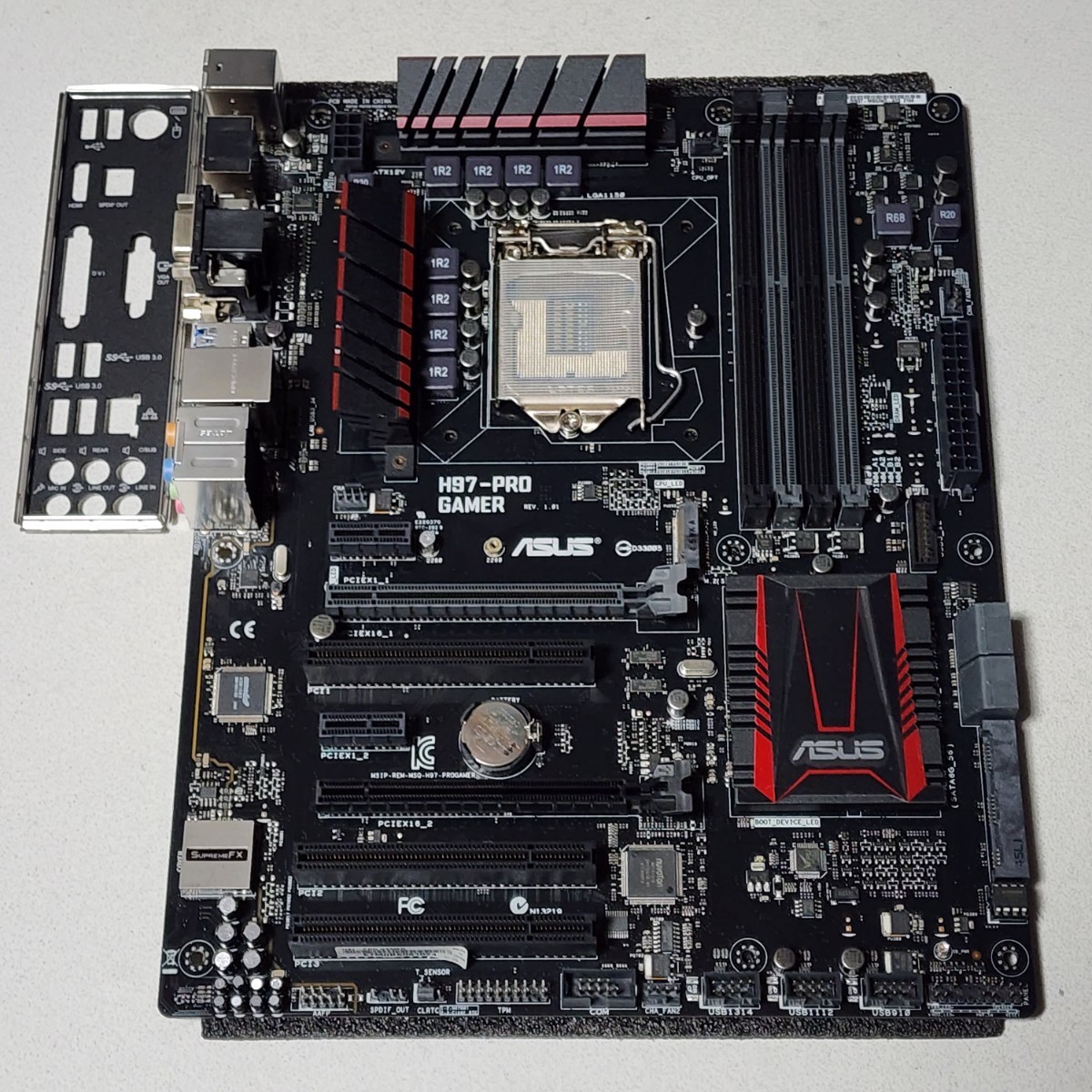

専門ショップ ATXマザーボード LGA1150 IOパネル付属 GAMER H97-PRO

ASUS - ASUS ROG STRIX B450-I GAMINGの通販 by mocomoco|エイスース

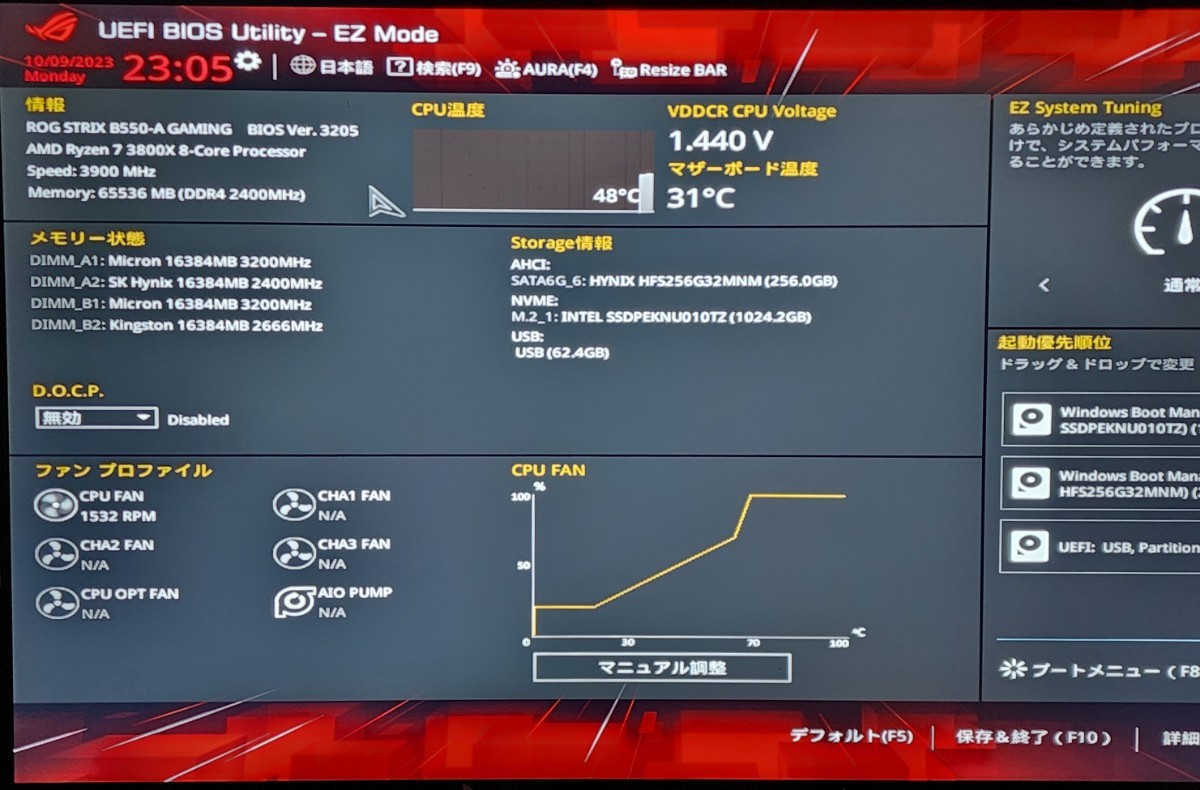

ASUS ROG STRIX B550-A GAMING IOパネル一体型 Socket AM4 ATX

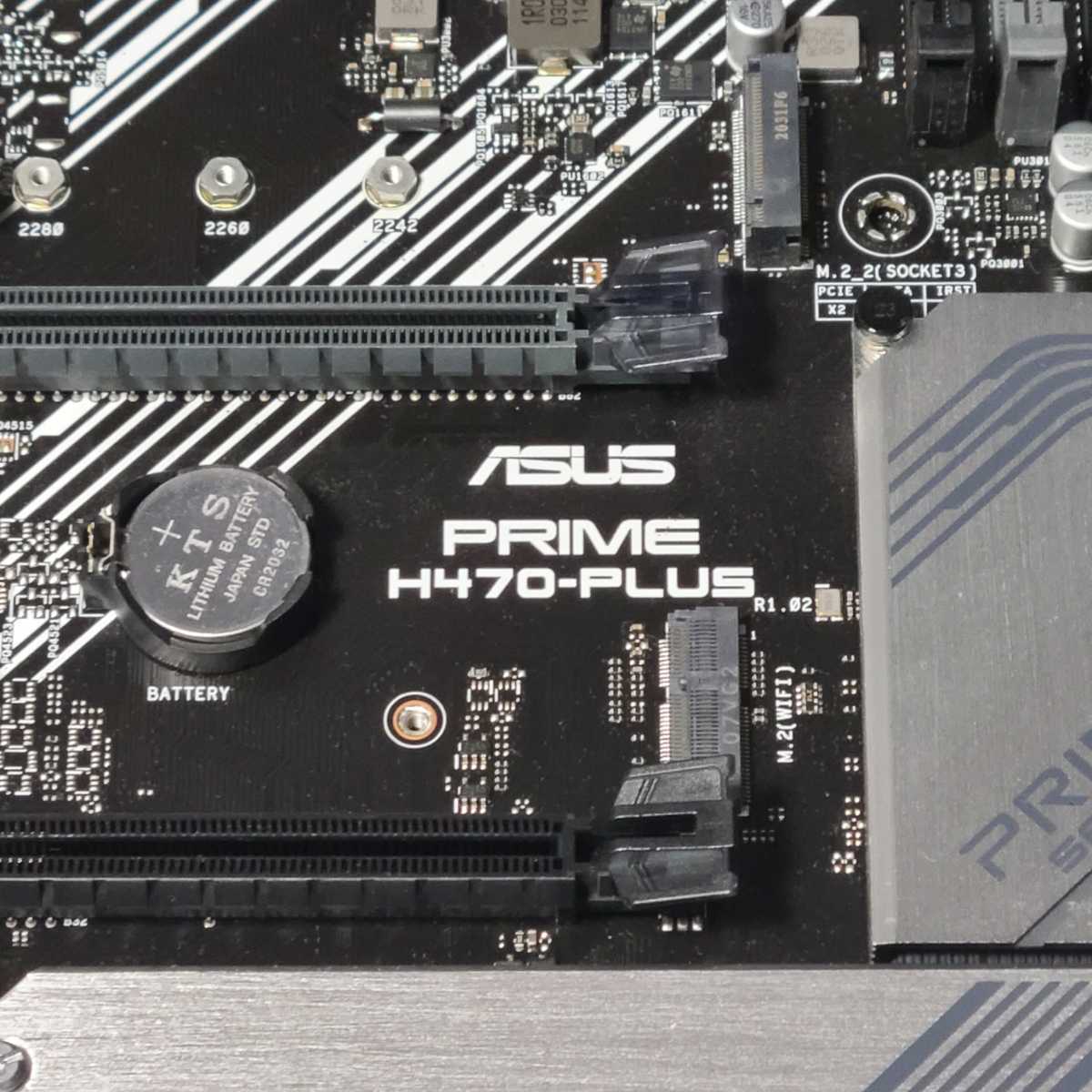

ASUS PRIME H470-PLUS IOパネル付属 LGA1200 ATXマザーボード 第10世代

MSI MPG X570 GAMING PLUS IOパネル付属 Socket AM4 ATXマザーボード

ROG STRIX B450-I GAMING | マザーボード | ROG Japan

ASUS ROG STRIX B550M-I GAMING IOパネル付属 Socket AM4 Mini-ITXマザーボード RYZEN5000シリーズ対応 最新Bios 動作確認済 PCパーツ

MSI MPG X570 GAMING PLUS IOパネル付属 Socket AM4 ATXマザーボード

ROG STRIX B450-I GAMING | マザーボード | ROG Japan

ASUS ROG STRIX Z390-F GAMING IOパネル一体型 LGA1151 ATXマザーボード 第8・9世代CPU対応 最新Bios 動作確認済 PCパーツ

100%正規品 H370-PRO TUF ASUS 動作確認済 GAMING マザーボード

再再販! + Z490 MPG 【動作確認済み】MSI intel 10700kf i7 PCパーツ

ASUS ROG STRIX X570-I GAMING オークション比較 - 価格.com

ASUS ROG STRIX Z690-I GAMING WIFI LGA1700 mini itxマザーボード

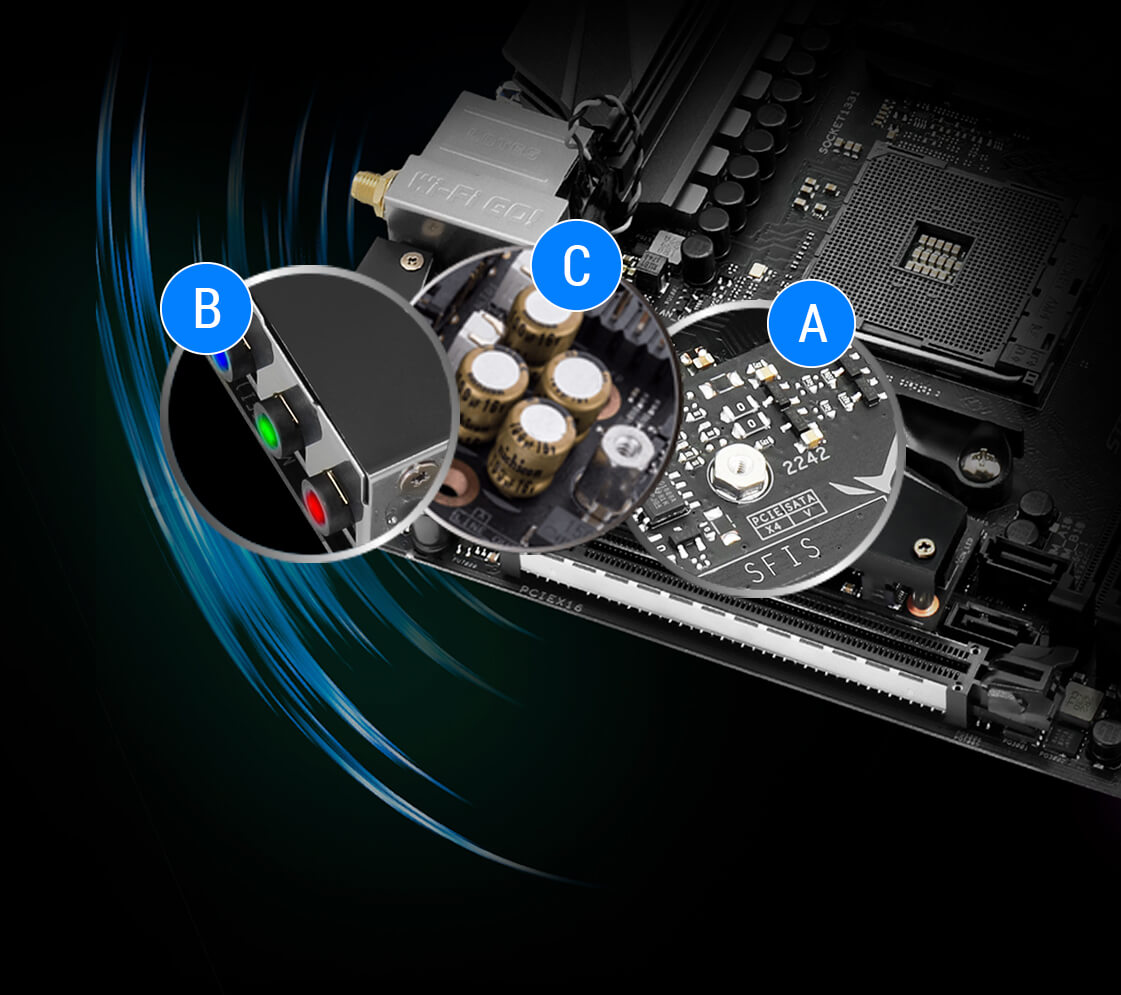

Mini-ITXながら本格ゲーミング志向の高品質パーツを採用したASUS「ROG

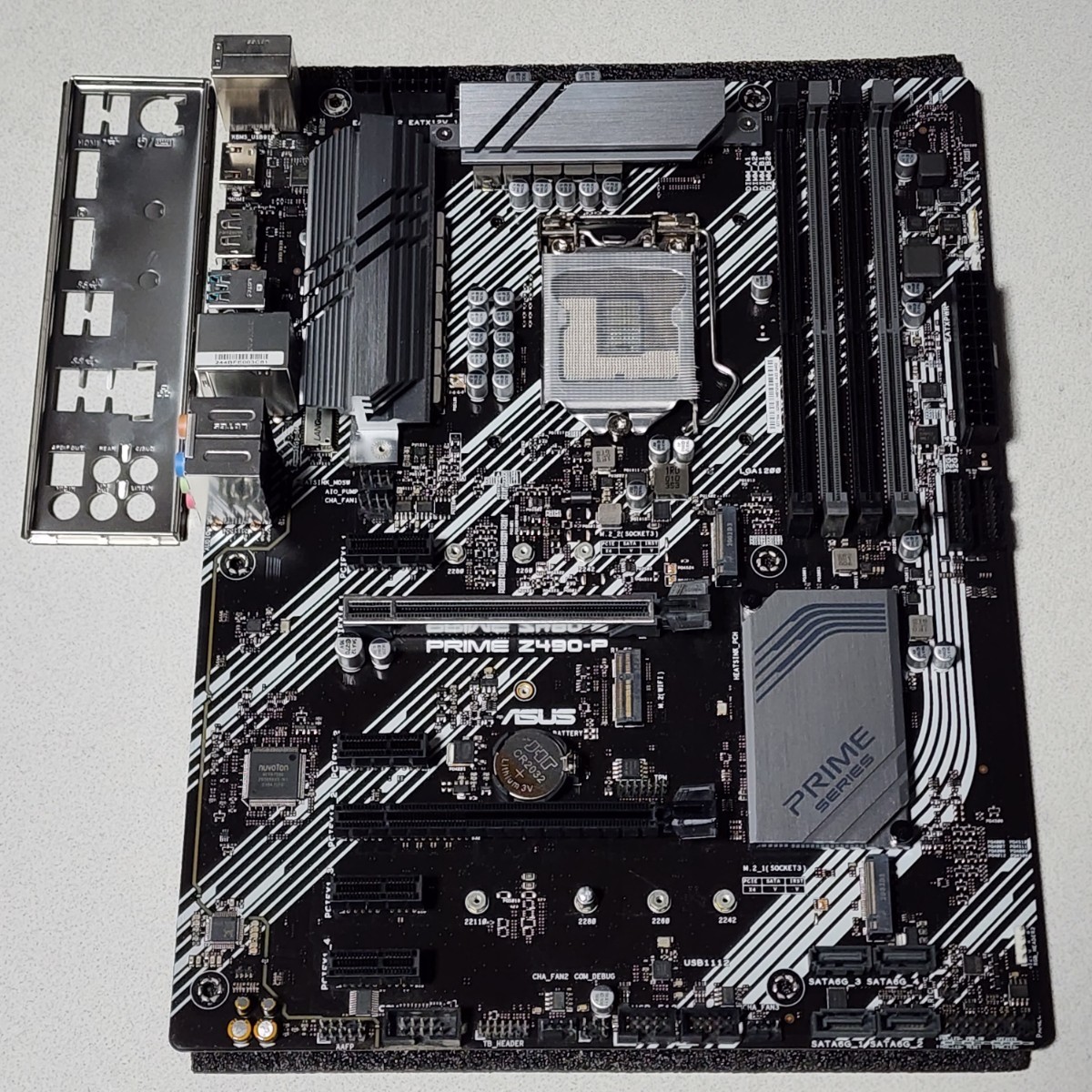

ASUS PRIME Z490-P IOパネル付属 LGA1200 ATXマザーボード 第10世代CPU

ROG STRIX B450-I GAMING | マザーボード | ROG Japan

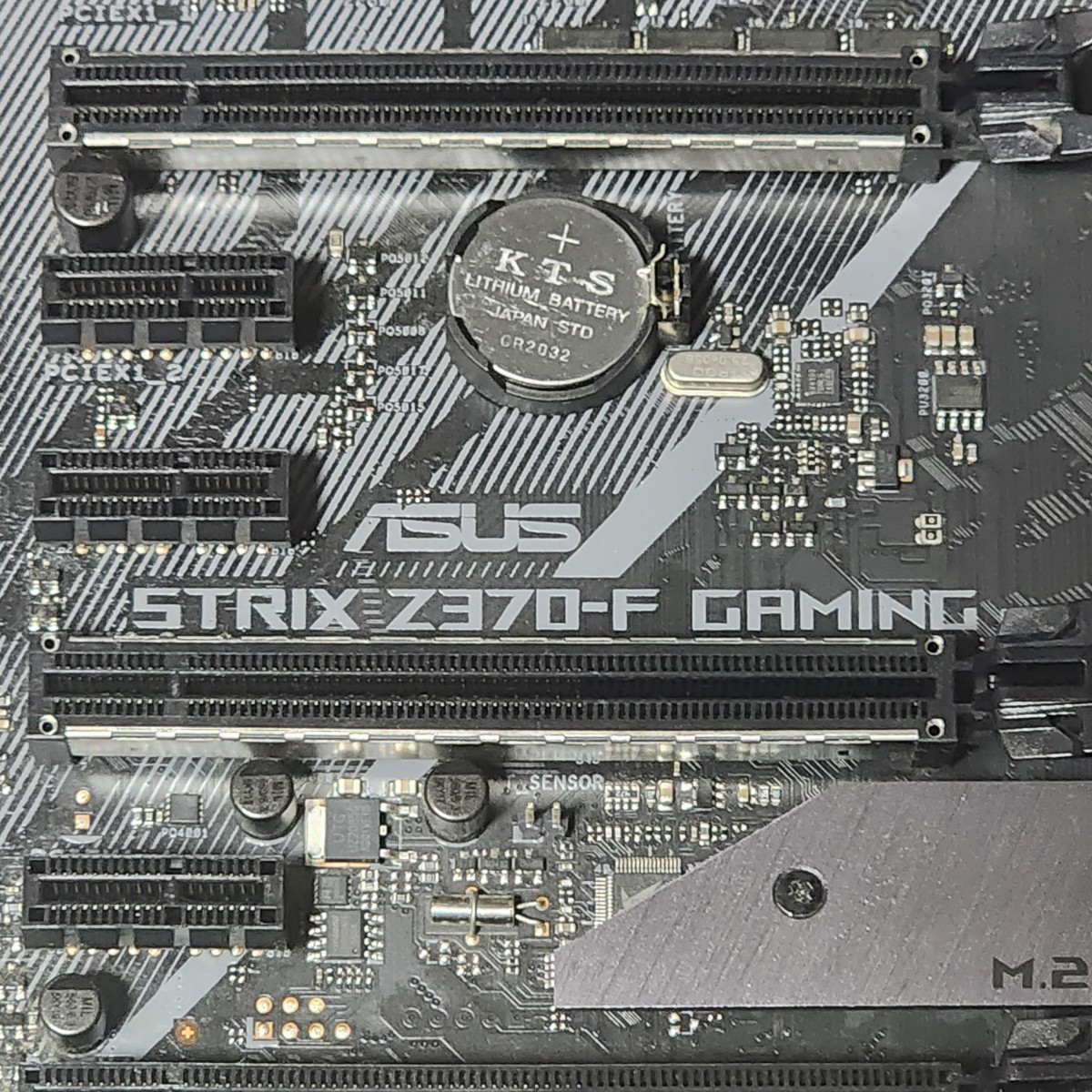

ASUS ROG STRIX Z370-F GAMING IOパネル付属 LGA1151 ATXマザーボード 第8・9世代CPU対応 最新Bios 動作確認済 PCパーツ

大好き 動作確認済み EVGAマザーボードZ97 221012-2 [電源CPUメモリ

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています