【andy様】カトリーヌ・リス ワイン 3本セット

(税込) 送料込み

商品の説明

フランス、アルザスの生産者、カトリーヌ・リスのワイン3本セットの出品です。

・シッフェルベルグ リースリング2015

・ドゥス ・ド・ターブル2016

・ドゥス ・ド・ターブル2017

セラーにて保管しております。

梱包材で巻いて段ボールにて発送致します。

カトリーヌ・リスはこの他に

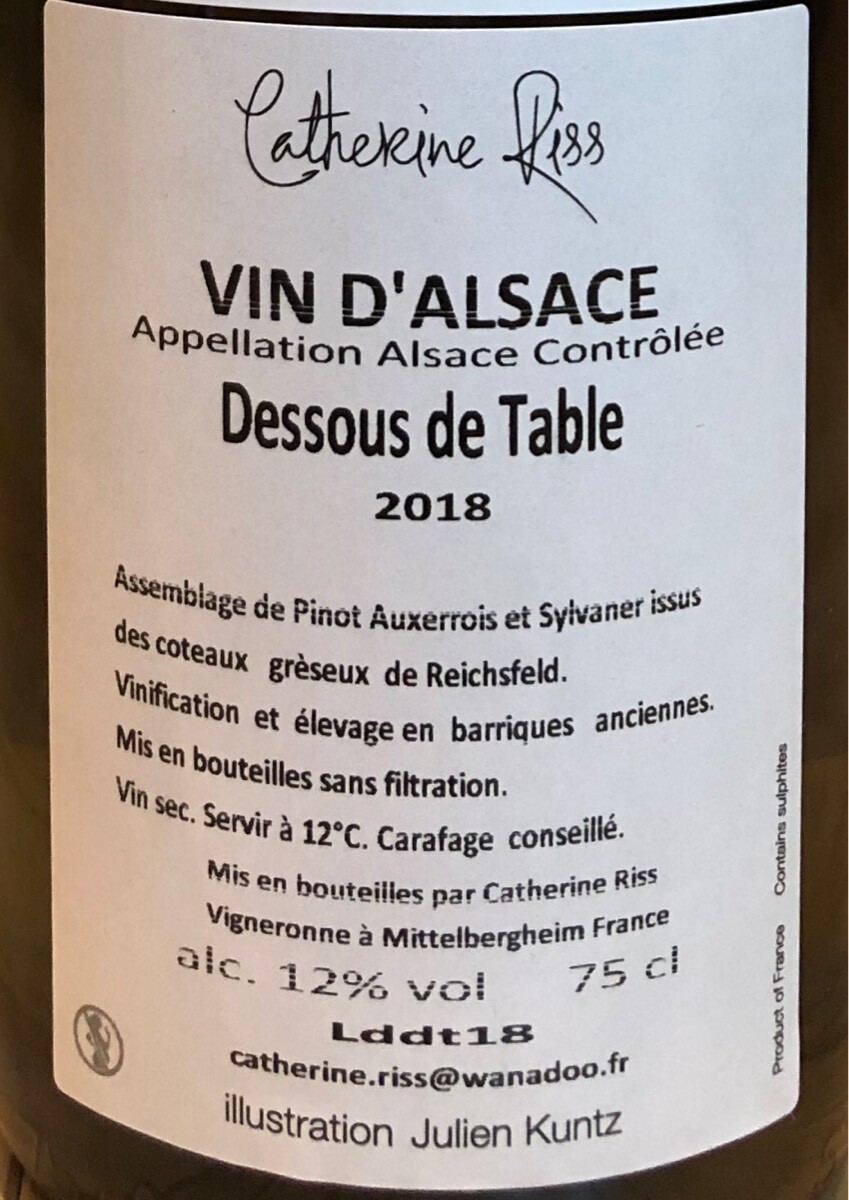

・ドゥス ・ド・ターブル2018

・リースリング ド・グレ・ウ・ド・フォルス 2018

の最新ビンテージも2本ありますので、ご興味のある方はコメントにてメッセージ下さい。

#ドメーヌタカヒコ #ラディコン商品の情報

| カテゴリー | その他 > 飲料/酒 > ワイン |

|---|---|

| 商品の状態 | 新品、未使用 |

2023年最新】アルザスワイン リースリングの人気アイテム - メルカリ

カトリーヌ・リス/アルザス・ピノノワール・タ・パ・ドゥ

Alsace Pinot Noir Empreinte 2021 アルザス・ピノノワール アンプラント / Catherine RISS カトリーヌ・リス

カトリーヌ リス アルザス ピノノワール アンプラント 2021 750ml

シャンパン ボランジェ・ヴーヴクリコ ホワイトラベル他 4本 注目

通販 高島屋 松本零士オリジナルワインセット ワイン

エンジェル HARO ヘイロー ブルー 750ml 12.5%シャンパン 【2022春夏

限定製作】 アルマンドグリーン マスターズエディション750ml(箱あり

2022春夏新作】 モエ・エ・シャンドン ハリーウィンストン コラボ レア

偉大な 十四代 龍の落とし子 純米吟醸 - conadeh.hn

カトリーヌ・リス/アルザス・ピノノワール アンプラント AC Alsace Pinot Noir 2021 Empreinte

ベルエポック白・ロゼ750ml 2本セット 贅沢 51.0%OFF www.mairiedesare.fr

在庫僅少】 モンガク谷ワイナリー ワイン - evivamultimedicos.com.br

驚きの価格が実現! 2015 プピーユ フランス ボルドー コート・ド

バランタイン 30年 人気デザイナー 49.0%割引 www.coopetarrazu.com

公式売れ筋 ドンペリニヨン ヴィンテージ 2010 ワイン

カトリーヌ リス ピエ ド ネ 2020 750ml

カトリーヌ・リス アーカイブ - wineshop TAI

カトリーヌ・リス アルザス ドゥス・ド・ターブル 2018 白 750ml

Catherine Riss Dessous de Table(カトリーヌ・リス | Vinica 無料の

フランス,アルザス,カトリーヌ・リス | 円山屋今村昇平商店 | MARUYAMAYA

通販 高島屋 松本零士オリジナルワインセット ワイン

CAMUS RESERVE EXTRA VIEILLE1863カミュ エクストラ ずっと気になって

カトリーヌ・リス アルザス ドゥス・ド・ターブル 2018 白 750ml

![ピノ・ノワール・タ・パ・ドゥ・シスト?[2020]カトリーヌ・リス](https://www.shonanwinecellar.com/admin/wysiwygUpload/shonanwinecellar/2019/04/max_20190403155643_0.jpg)

ピノ・ノワール・タ・パ・ドゥ・シスト?[2020]カトリーヌ・リス

Catherine Riss Empreinte Pinot Noir(カトリーヌ・リス アンプラント

十四代 空瓶 新発売 29400円引き www.homeservicesrl.com

カトリーヌ・リス (Catherine RISS) No.53|【有限会社ヴァンクゥール

絶賛商品 アナ・デ・コドルニウ リミテッドエディション 750ml ワイン

カトリーヌ・リス - 湘南ワインセラー

カトリーヌ・リス(アルザス) - 酒のあべたや

K127 サントリー 響 17年 ウィスキー ゴールドラベル 750ml 43

カトリーヌ リス アルザス ピノノワール アンプラント 2021 750ml

カトリーヌ・リス | 自然派ワインとウイスキー ヴァンエボヌール

Alsace Pinot Noir Libre comme l'air 2020 アルザス・ピノノワール リーブル・コム・レール / Catherine RISS カトリーヌ・リス

KRUG クリュグ 品多く

ヴァイングート ヴァイガント ロゼ 2021【ロゼ】750ml | wineshop W

在庫特価品 2015 チリワイン ワイン - LITTLEHEROESDENTISTRY

シャンパン ボランジェ・ヴーヴクリコ ホワイトラベル他 4本 注目

CAMUS RESERVE EXTRA VIEILLE1863カミュ エクストラ ずっと気になって

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています