クロムハーツ ヘアゴム ブレスレット インボイス原本 コンチョ バングル クロス

(税込) 送料込み

商品の説明

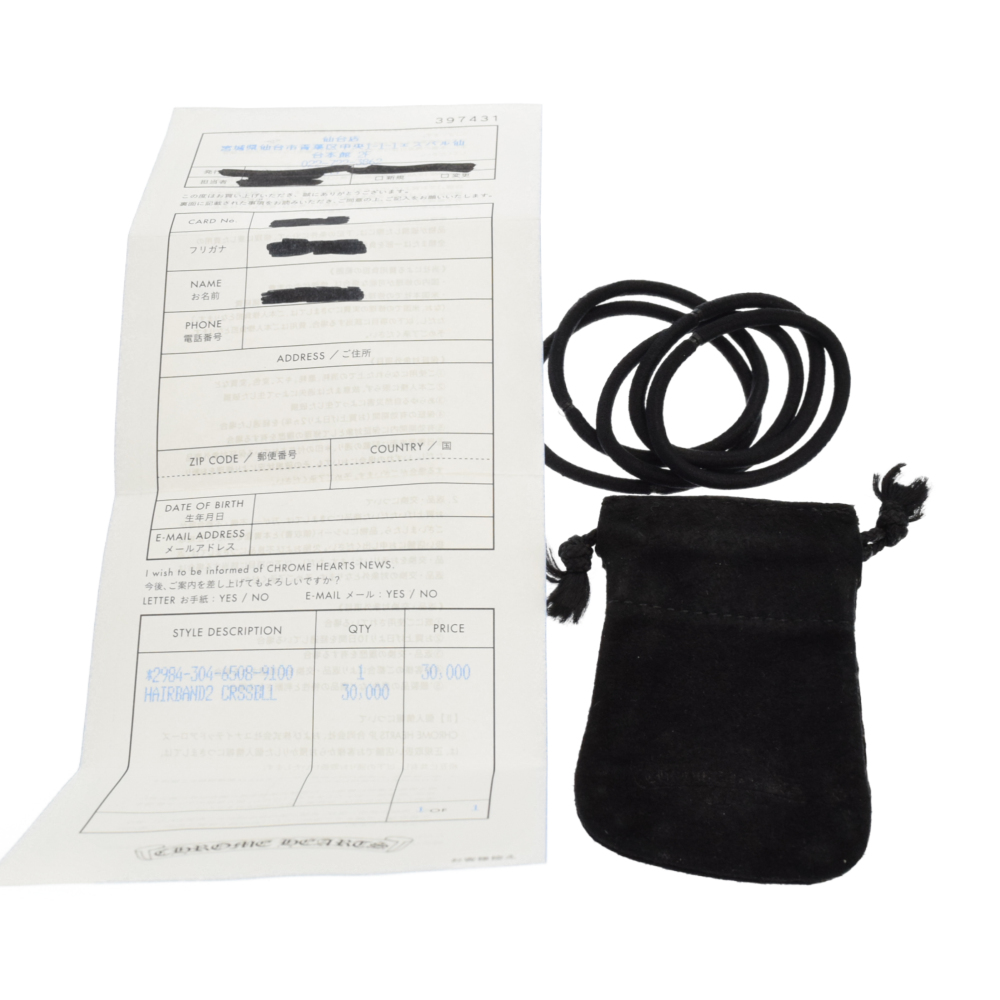

CHROME HEARTS(クロムハーツ)

クロムハーツ ヘアゴム クロスボール

付属品完備

ショッパー シルバークロス 革袋 BOX

購入時の購入証明証原本付き(インボイス)

使用に伴う小傷や燻みがありますが、まだまだ使用可能です。気になる方は磨きに出せば新品同様になるかと思います。

確実正規品をお求めの方いかがでしょう?

インボイスの個人情報部分は削除させていただきますのでご了承下さい。

何かあればコメントお願い致します。商品の情報

| カテゴリー | メンズ > アクセサリー > ブレスレット |

|---|---|

| ブランド | クロムハーツ |

| 商品の状態 | やや傷や汚れあり |

クロムハーツ ヘアゴム ブレスレット インボイス原本 コンチョ

Chrome Hearts クロムハーツ ヘアゴム コンチョ | hartwellspremium.com

クロムハーツ ヘアゴム ブレスレット インボイス原本 コンチョ

クロムハーツ ヘアゴム ブレスレット インボイス原本 コンチョ

✨インボイス付き✨クロムハーツ クロスボール コンチョ ヘアゴム

Chrome Hearts - クロムハーツ ヘアゴム コンチョ インボイス原本

CHROME HEARTS ヘアゴム コンチョ | hartwellspremium.com

交換無料! インボイス付き CHROME HEARTS クロスボール ヘアゴム

2022年ファッション福袋 ♯2 オールド 旧型 ヘアゴム コンチョ ボタン

クロムハーツ シルバー 925 クロスボールボタン HAIRBAND ヘアゴム

予約販売】本 正規特注オーダーメイド品 CHROME ダイヤモンド使用

クロムハーツ ヘアゴム ハート HAIRBAND HEART コンチョ ブレス-

【送料無料/新品】 クロムハーツ HEARTS CHROME 正規品 CH

肌触りがいい クロムハーツ ゴム Chromhearts ヘアゴム 通販 初期 2枚

ONE STYLE by BRING クロムハーツ・ゴローズの買取・販売・通販専門店

ONE STYLE by BRING クロムハーツ・ゴローズの買取・販売・通販専門店

ONE STYLE by BRING クロムハーツ・ゴローズの買取・販売・通販専門店

オープニング 大放出セール クロムハーツ エクストラフローラルクロス

もらって嬉しい出産祝い ガンスリンガー クロムハーツ HEARTS CHROME

特価ブランド クロムハーツ BSフレアコンチョ ヘアゴム ブレスレット

豊富なギフト silver925 クロムハーツ CHプラスミニIDブレス Hearts

クロムハーツ ハート ヘアゴム ヘアバンド インボイス クロスボール

インボイス/原本】CHROME HEARTS/クロムハーツ クロスコンチョ

クロムハーツ クロスヘアゴムコンチョ - ブレスレット/バングル

ONE STYLE by BRING クロムハーツ・ゴローズの買取・販売・通販専門店

在庫あり/即出荷可】 CHROME HEARTS ブラック系【中古】 ブレスレット

クロムハーツ ヘアゴム(ブラック/黒色系)の通販 28点 | Chrome

Chrome Hearts クロムハーツ ヘアゴム コンチョ パーティを彩るご馳走

国内発送-Chrome Hearts - クロムハーツ ヘアゴム ブレス•レッ•ト

贅沢屋の ♯2 新型 ヘアゴム シルバー コンチョ ボタン クロスボール

CHROME HEARTS クロムハーツ(原本有) ブレスレット HAIRBAND クロス

クロムハーツ ヘアゴム ハート HAIRBAND HEART コンチョ ブレス-

正規逆輸入品】 BENT クロムハーツ(原本無) HEARTS CHROME CH

Chrome Hearts - クロムハーツ CHROME HEARTS クロスボール

販売オーダー クロムハーツクロスボールヘアゴム ブレスレット

完成品 HEARTS CHROME クロムハーツ(原本無) シルバー系【中古

Chrome Hearts - CHROME HEARTS クロムハーツ(原本有) ブレスレット

新作入荷!!】 クロムハーツ Chrome SS07 中古 シルバーブレスレット

美品】ヘアゴム クロスボール ブレスレット インボイス原本無修正

クロムハーツ ショッパー ブレスレット(メンズ)の通販 64点 | Chrome

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています