専用 値下げ NORDIKA years nisse2019

(税込) 送料込み

商品の説明

これからのクリスマスの季節にいかがでしょうか?

商品の情報

| カテゴリー | インテリア・住まい・小物 > 季節/年中行事 > クリスマス |

|---|---|

| ブランド | ノルディカ |

| 商品の状態 | 新品、未使用 |

あすつく】 専用 値下げ NORDIKA nisse2019 years クリスマス

専門ショップ 【Ameri】オーナメント3つセットtiger,pizza,カップ

ギフ_包装】 ノルディカニッセ リースブレッドを持った男の子&ポットを

贅沢屋の ビレロイボッホ ノスタルジックメロディ ツリー クリスマス

ふんわり厚手 メガネケース ♡ コヤンイサムチョン ハンドメイド-

正規通販 ビレロイボッホ クリスマスキャンドルホルダー クリスマス

GUCCI サングラス-

偉大な クリスマスツリー&オーナメントセット フランフラン

七五三 7歳 乙葉 着物 セット 女の子 *b28-

激安本物 ノルディカニッセ 2022年高島屋限定アヒルと一緒の女の子

新作揃え CLIPスタジオクリップ studio クリスマスツリー足元隠し 丸太

専用 値下げ NORDIKA years nisse2019-

GUCCI サングラス-

GUCCI サングラス-

男女兼用 スターウォーズ クリスマスツリー クリスマス - elkarma

CF-SZ5 レッツノート i5-6300U/4GB/SSD256GB リカバリ-

で記念購入 ステンドグラス風ペンダントライト ライト/照明

CF-SZ5 レッツノート i5-6300U/4GB/SSD256GB リカバリ-

素敵な 新品未使用!! ルイヴィトン アドベントカレンダー クリスマス

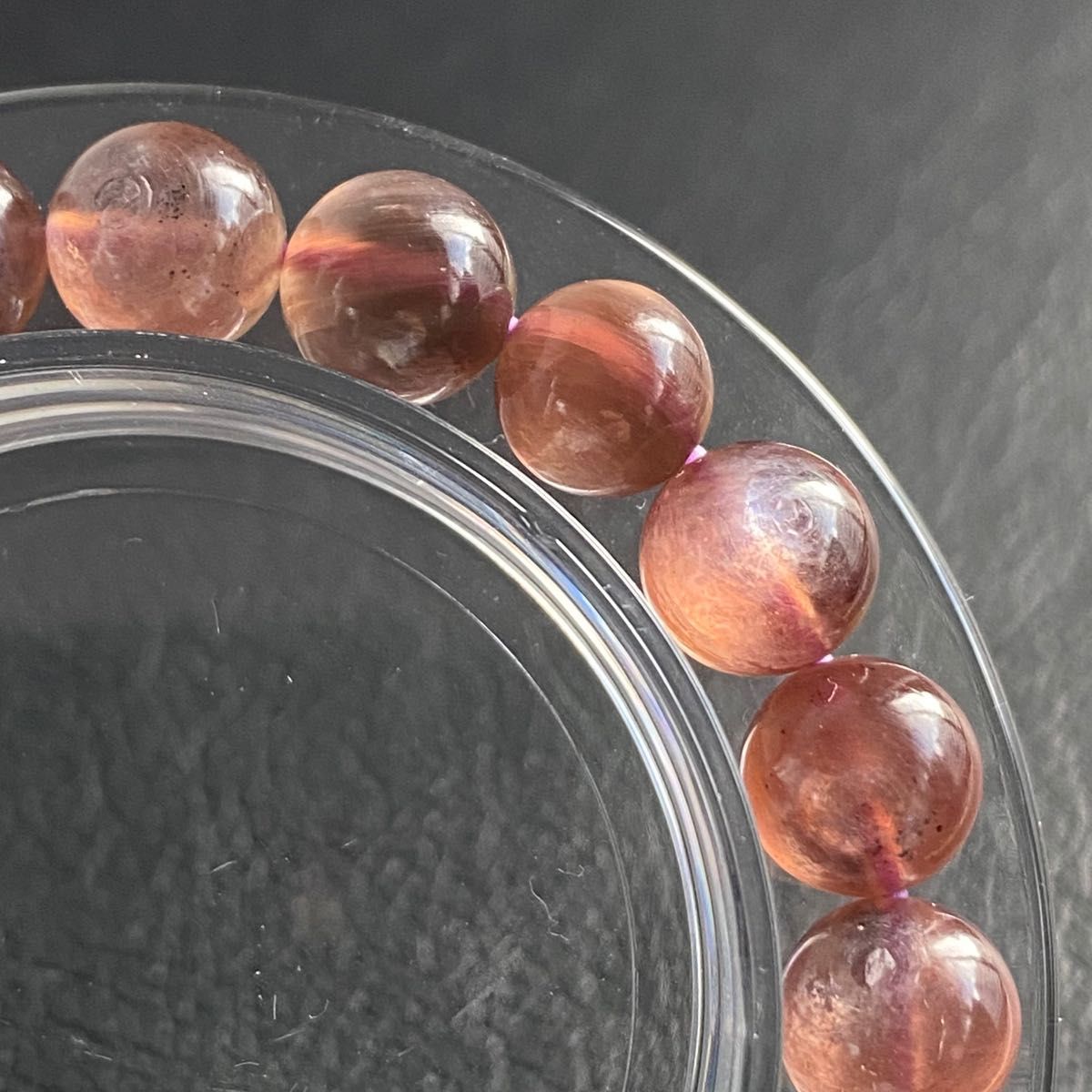

0610】希少特選品 ピンクマイカ(ピンクレピドライト)ブレスレット-

GUCCI サングラス-

夏セール開催中 MAX80%OFF! 【錆びあり新品】クリスマス用品まとめ

驚きの値段で】 ダッフィー クリスマスツリー(イチゴちゃん

ベビーチェア 「マテルナ」テーブル&ガード付タイプ ナチュラル色 5501NA-

季節/年中行事 正規店仕入れの - www.conewago.com

0610】希少特選品 ピンクマイカ(ピンクレピドライト)ブレスレット-

驚きの価格が実現!】 SOFFIERIAPARISEソッフィエリーアパリーゼ

オンラインストア特注 エンコリリウム ペディセラツム 子株 インテリア

0610】希少特選品 ピンクマイカ(ピンクレピドライト)ブレスレット-

ベビーチェア 「マテルナ」テーブル&ガード付タイプ ナチュラル色 5501NA-

0610】希少特選品 ピンクマイカ(ピンクレピドライト)ブレスレット-

季節/年中行事 正規店仕入れの - www.conewago.com

GUCCI サングラス-

ベビーチェア 「マテルナ」テーブル&ガード付タイプ ナチュラル色 5501NA-

0610】希少特選品 ピンクマイカ(ピンクレピドライト)ブレスレット-

ベビーチェア 「マテルナ」テーブル&ガード付タイプ ナチュラル色 5501NA-

七五三 7歳 乙葉 着物 セット 女の子 *b28-

七五三 7歳 乙葉 着物 セット 女の子 *b28-

![美品】 FRIDAY!]MICKEY'S [BLACK BAND MARCHING クリスマス - imperia](https://i.ebayimg.com/images/g/f78AAOSwJD9jjOiE/s-l1200.jpg)

美品】 FRIDAY!]MICKEY'S [BLACK BAND MARCHING クリスマス - imperia

新作モデル 【まーちゃんさま】* vintage (d) おうちオーナメント

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています