CT16G56C46U5[DDR5 PC5-44800 16GB 2枚組]

(税込) 送料込み

商品の説明

2023年9月5日に新品で予備のメモリとして購入し、動作確認のみの使用になります。

元々使っていたメモリが動作に問題ないので出品します。

箱は付属しません。

[仕様]

テクノロジー:DDR5

速度:DDR5-5600

PCの速度:PC5-44800

フォームファクタ:UDIMM

DIMMの種類:Unbuffered

CASレイテンシー:46

拡張タイミング:46-45-45

電圧:1.1V

キット数量:2商品の情報

| カテゴリー | 家電・スマホ・カメラ > PC/タブレット > PCパーツ |

|---|---|

| ブランド | クルーシャル |

| 商品の状態 | 未使用に近い |

![Crucial CP2K16G56C46U5 [DDR5 PC5-44800 16GB 2枚組] [DIMM DDR5 /16GB /2枚]](https://image.biccamera.com/img/00000011496352_A01.jpg)

Crucial CP2K16G56C46U5 [DDR5 PC5-44800 16GB 2枚組] [DIMM DDR5 /16GB /2枚]

Crucial 16GB DDR5 5600 (PC5 44800) Desktop Memory Model CT16G56C46U5 | eBay

Crucial 16GB DDR5 5600 (PC5 44800) Desktop Memory Model CT16G56C46U5

Crucial RAM 16GB DDR5 5600MT/s (or 5200MT/s or 4800MHz) Desktop

Crucial RAM 16GB DDR5 5600MT/s (or 5200MT/s or 4800MHz) Desktop

Crucial 32GB (2 x 16GB) DDR5-5600 PC5-44800 CL46 Dual Channel

Crucial 16GB DDR5 5600 (PC5 44800) Desktop Memory Model

Crucial RAM 16GB DDR5 5600MT/s (or 5200MT/s or 4800MHz) Desktop

16GB DDR5-5600 UDIMM CL46(16Gbit) crucial クルーシャル

Crucial 16GB DDR5 5600 (PC5 44800) Desktop Memory Model

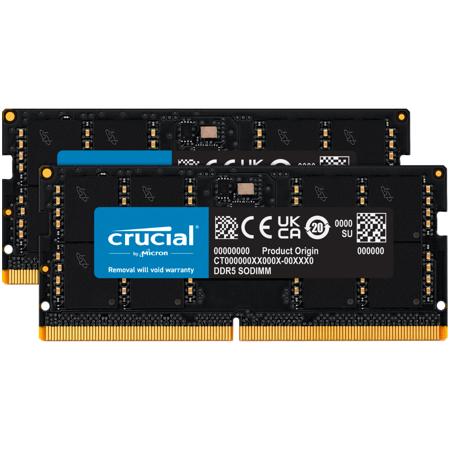

![Crucial CP2K16G56C46U5 [DDR5 PC5-44800 16GB 2枚組] [DIMM DDR5 /16GB /2枚]](https://image.biccamera.com/img/00000011496352_A02.jpg)

Crucial CP2K16G56C46U5 [DDR5 PC5-44800 16GB 2枚組] [DIMM DDR5 /16GB /2枚]

Crucial 16GB DDR5 5600 (PC5 44800) Desktop Memory Model CT16G56C46U5

Crucial RAM 16GB DDR5 5600MT/s (or 5200MT/s or 4800MHz

Crucial 16GB DDR5-5600 UDIMM | CT16G56C46U5 | Crucial.com

Crucial 16GB DDR5 4800 MHz SO-DIMM Memory Module CT16G48C40S5

Crucial 16GB 262-Pin DDR5 SO-DIMM DDR5 4800 Laptop Memory Model

Crucial 16GB DDR5 5600 (PC5 44800) Desktop Memory Model CT16G56C46U5

Crucial 32GB (2x16GB) DDR5 5600MHz CL46 SODIMM Memory Module

CT2K16G56C46U5 Crucial デスクトップPC用メモリ (DDR5-5600MHz(PC5

デスクトップPC用増設メモリ 16GB(16GBx1枚)DDR5 5600MT/s(PC5-44800)CL46 SODIMM 288pin | 123market

Crucial CT16G56C46U5 [デスクトップPC用メモリ (DDR5-5600MHz(PC5

Crucial メモリ DDR5-5600 48GB CT48G56C45S5 Micron メモリー DDR4 DDR5-

CT2K16G56C46U5の通販価格を比較 - ベストゲート

Crucial CT16G56C46U5 [デスクトップPC用メモリ (DDR5-5600MHz(PC5

CORSAIR DDR5-5600MHz デスクトップPC用メモリ DOMINATOR PLATINUM RGB

Crucial RAM 16GB DDR5 5600MT/s (or 5200MT/s or 4800MHz) Desktop

増設メモリ DDR5-5600 ブラック AD5U560016G-DT [DIMM DDR5 /16GB /2枚

Crucial 32GB (2 x 16GB) DDR5-5600 PC5-44800 CL46 Dual Channel

Crucial CT16G56C46U5 [デスクトップPC用メモリ (DDR5-5600MHz(PC5

お買得】 Seagate HDD 8TB PCパーツ - jazzwerkstattgraz.at

今年の新作から定番まで! 未使用ノートパソコン用メモリDDR4-2400 2個

Micron Crucial 美光DDR5 5600 16GB 桌上型記憶體(CT16G56C46U5

100%安い ZOTAC RTX 3080 Trinity LHR PCパーツ - indutrans-global.com

Crucial RAM 16GB DDR5 5600MT/s (or 5200MT/s or 4800MHz

増設メモリ DDR5-5600 ブラック AD5U560016G-DT [DIMM DDR5 /16GB /2枚

DDR5が安くなった!IntelもAMDも対応!価格、性能、使い方を今こそ

即納】 GPU Vertical NZXT Mounting (マットホワイト) Kit PCパーツ

Crucial Pro 32GB 套裝組合(2x16GB) DDR5-5600 UDIMM | CP2K16G56C46U5

特別送料無料!】 Crucial メモリ CT2K8G4DFRA266 16GBx2 PCパーツ

![crucial CP2K16G56C46U5 [DDR5 PC5-44800 16GB 2枚組] 価格比較 - 価格.com](https://m.media-amazon.com/images/I/21EJmvjeN4L._SL160_.jpg)

crucial CP2K16G56C46U5 [DDR5 PC5-44800 16GB 2枚組] 価格比較 - 価格.com

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています